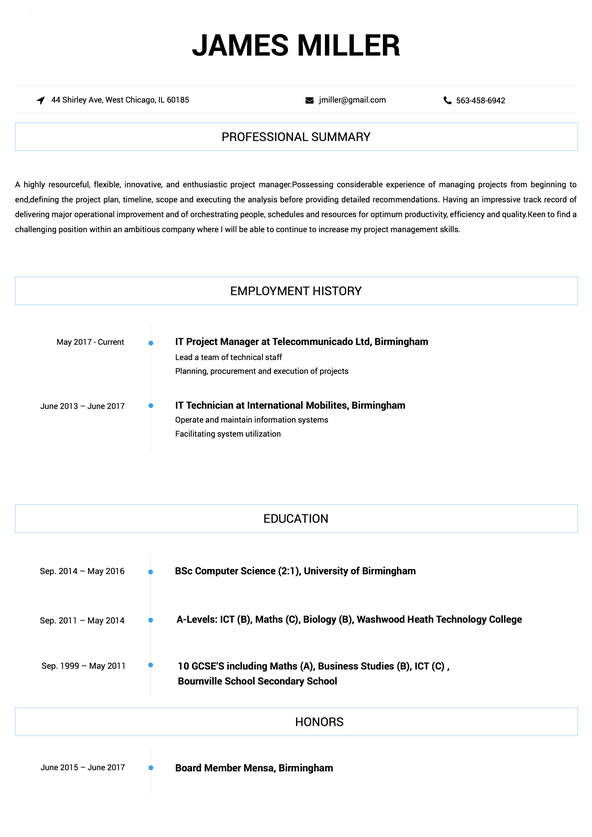

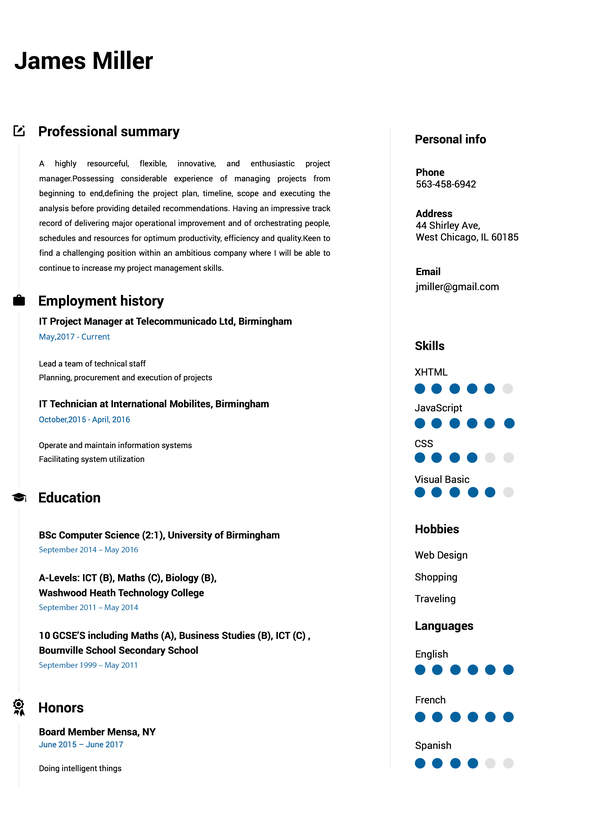

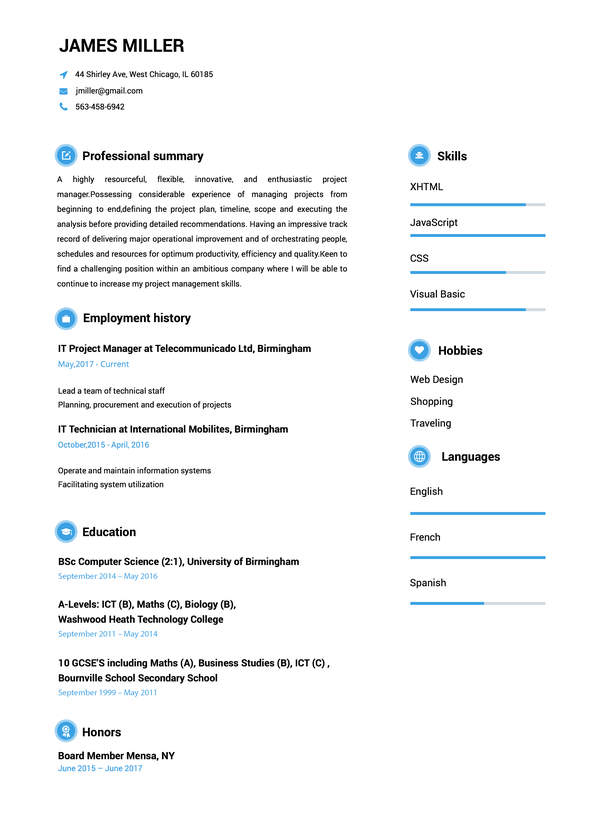

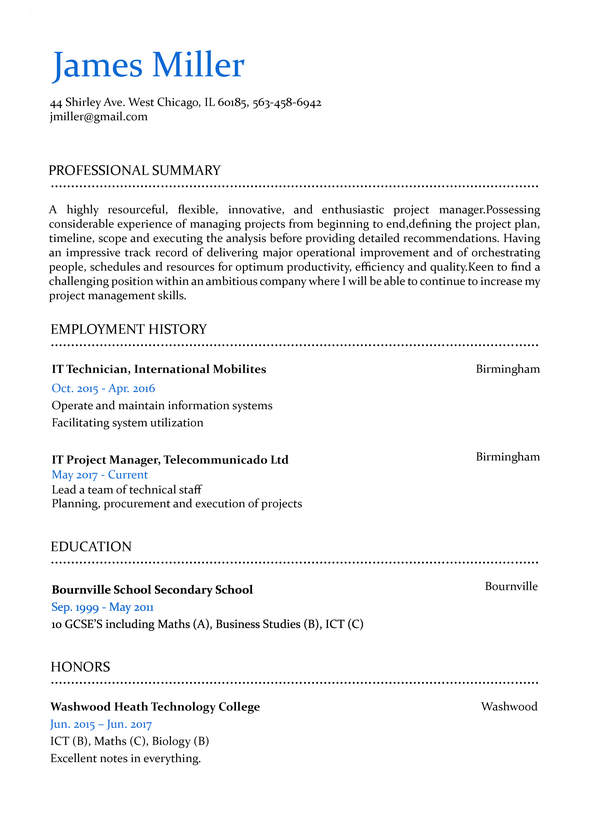

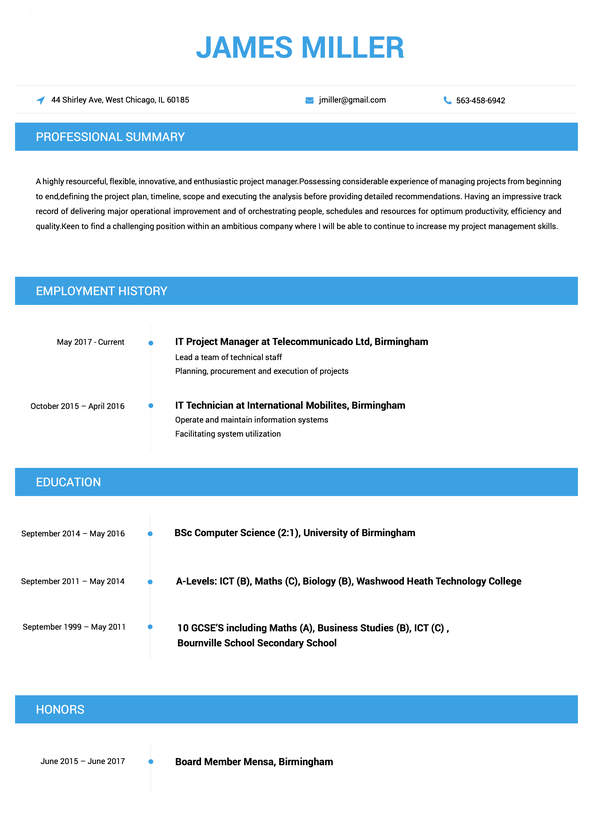

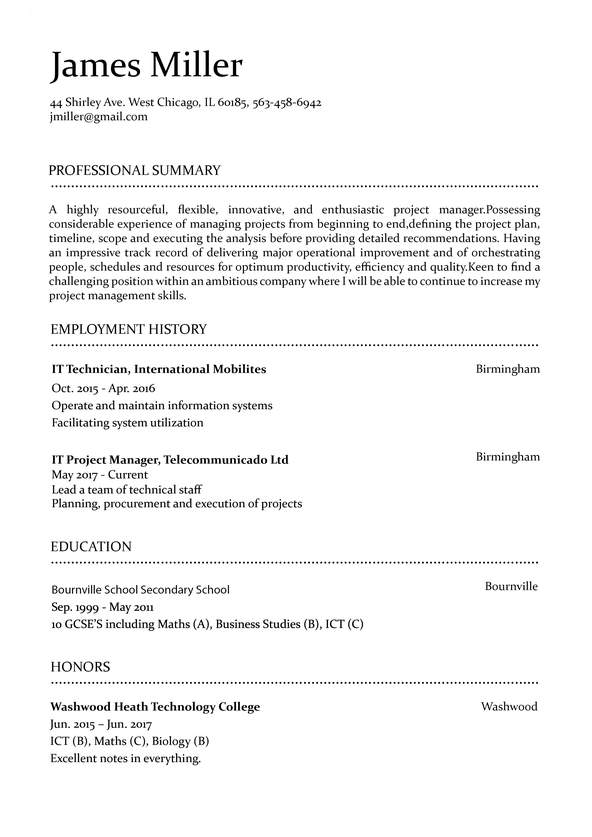

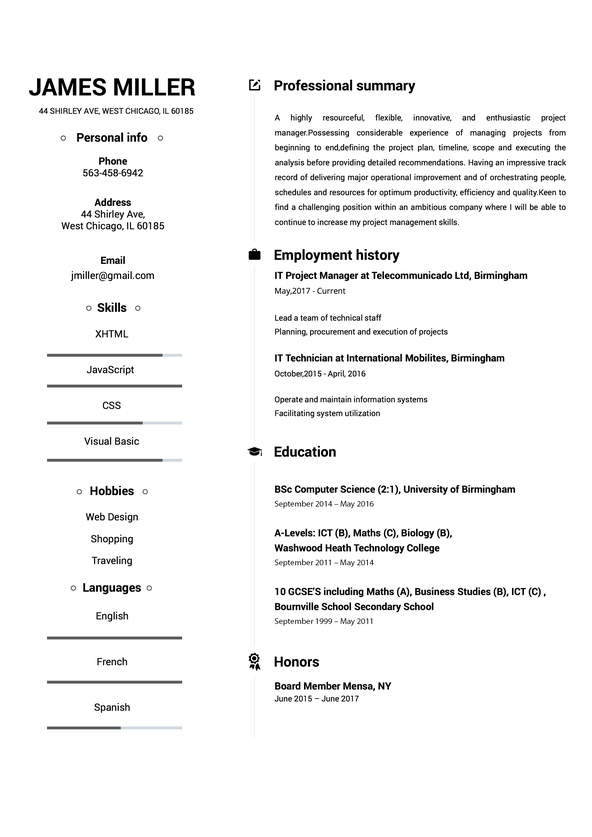

Use This Template

Use This Template

Build your resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.

debt collector: Resume Samples & Writing Guide

Employment history

- Recommend accounts for write-off or credit adjustment

- Utilize skip tracing techniques to locate debtors

- Develop and maintain relationships with clients

- Negotiate payment plans with debtors

- Contact debtors via telephone and/or written correspondence

- Monitor accounts to identify and recover delinquent accounts

- Recommend accounts for write-off or credit adjustment

- Prepare and submit legal documents for court filings

- Negotiate payment plans with debtors

Education

Skills

Do you already have a resume? Use our PDF converter and edit your resume.

Employment history

- Prepare and submit legal documents for court filings

- Analyze and review accounts for potential legal action

- Monitor accounts to identify and recover delinquent accounts

- Investigate and resolve customer inquiries and complaints

- Maintain accurate records of collection efforts

- Develop and maintain relationships with clients

- Prepare reports on collection activity

- Investigate and resolve customer inquiries and complaints

- Develop and maintain relationships with clients

Education

Skills

Professional Summary

Employment history

- Maintain accurate records of collection efforts

- Prepare and submit legal documents for court filings

- Recommend accounts for write-off or credit adjustment

- Monitor accounts to identify and recover delinquent accounts

- Negotiate payment plans with debtors

- Provide regular updates to clients on the status of collections

- Monitor accounts to identify and recover delinquent accounts

- Contact debtors via telephone and/or written correspondence

- Ensure compliance with state and federal laws regarding debt collection

Education

Skills

Employment history

- Ensure compliance with state and federal laws regarding debt collection

- Utilize skip tracing techniques to locate debtors

- Develop and maintain relationships with clients

- Perform skip tracing activities to locate debtors

- Utilize skip tracing techniques to locate debtors

- Investigate and resolve customer inquiries and complaints

- Analyze and review accounts for potential legal action

- Maintain accurate records of collection efforts

- Recommend accounts for write-off or credit adjustment

Education

Skills

Employment history

- Prepare and submit legal documents for court filings

- Utilize skip tracing techniques to locate debtors

- Assist in training and mentoring new debt collectors

- Develop and maintain relationships with clients

- Investigate and resolve customer inquiries and complaints

- Utilize skip tracing techniques to locate debtors

- Analyze and review accounts for potential legal action

- Contact debtors via telephone and/or written correspondence

- Develop and maintain relationships with clients

Education

Skills

Not in love with this template? Browse our full library of resume templates

debt collector Job Descriptions; Explained

If you're applying for an debt collector position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers.

When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

debt collector

- call debtors and set up payment plans for them.

- pacifying angry customers.

- updating the system with the latest information on a customer.

- Listen to customer requests

- Provide assistance for customers with special billing requests. to answer questions and provide telephone information.

debt collector

- Collect debt on credit cards (Visa ,MasterCard, Capital One , American Express ) and Home and Auto loans .

- Skip trace and locate customers to attempt to collect a debt .

- Take payments with customers and assist with fund verification with different banks .

- Assist with fund transfers from 401k.

- De-escalate irate customers .

- Take supervisor calls from other agents .

- Provide second talk off for other agents who needed assistance when closing a deal .

debt collector/loan officer

- Transmit and receive messages, using telephones a Microsoft

- Arrange for debt repayment or establish repayment schedules, based on customers’ financial situations. access database

- Loan Assessment

- Junior IT

- Minimal Graphic Design work

debt collector

- Assisted with cancellations and resale options if they were available

- Helped resolve any issues and resolve members account to make the member satisfied

- Set up tasks on a daily basis for further review

- Receive 50+ calls on a daily basis and made outgoing calls for follow up

debt collector

- Make outbound contact to debtors regarding delinquent accounts and negotiate settlement options.

- Take inbound telephone calls from debtors regarding delinquent accounts and negotiate settlement options.

- Prepare correspondence on delinquent accounts.

- Research disputed delinquent account balances and make necessary corrections.

- Review accounts to be recommended for closure and assist in report preparation.

debt collector Job Skills

For an debt collector position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job effectively. Some examples of technical skills are data analysis, project management, software proficiency, and programming languages, to name a few.

Add the technical skills that will get hired in your career field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills section of the builder, manually write in the skill or simply click on "Add more skills". This will automatically generate the best skills for your career field, choose your skill level, and hit "Save & Next."

- Data Entry

- Bookkeeping

- Accounts Receivable

- Accounts Payable

- Financial Analysis

- Cash Flow Management

- Credit Analysis

- Reconciliation

- Collections

- Bankruptcy

- Budgeting

- Auditing

- Tax Preparation

- Microsoft Excel

- Microsoft Word

- QuickBooks

- Law Knowledge

- Negotiation Skills

- Compliance

- Data Analysis

- Financial Modeling

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your problem-solving abilities and show that you navigate challenges and changes in the workplace efficiently.

Add competitive soft skills to make your resume stand-out to recruiters! Simply select your preferred resume template in the skills section, enter the skills manually or use the "Add more skills" option. Our resume builder will generate the most relevant soft skills for your career path. Choose your proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Leadership

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Creativity

- Adaptability

- Teamwork

- Organization

- Planning

- Public Speaking

- Negotiation

- Conflict Resolution

- Research

- Analytical

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Coaching

- Mentoring

- Listening

- Networking

- Strategic Thinking

- Negotiation

- Emotional Intelligence

- Adaptability

- Flexibility

- Reliability

- Professionalism

- Computer Literacy

- Technical

- Data Analysis

- Project Management

- Customer Service

- Presentation

- Written Communication

- Social Media

- Troubleshooting

- Quality Assurance

- Collaboration

- Supervisory

- Risk Management

- Database Management

- Training

- Innovation

- Documentation

- Accounting

- Financial Management

- Visualization

- Reporting

- Business Acumen

- Process Improvement

- Documentation

- Relationship Management.

How to Improve Your debt collector Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Percy Griffin

569 Pine St., Sumner, WA 98390Employment history

- Negotiate payment plans with debtors

- Maintain accurate records of collection efforts

- Investigate and resolve customer inquiries and complaints

- Analyze and review accounts for potential legal action

- Contact debtors via telephone and/or written correspondence

- Perform skip tracing activities to locate debtors

- Perform skip tracing activities to locate debtors

- Monitor accounts to identify and recover delinquent accounts

- Assist in training and mentoring new debt collectors

Education

Skills

Provide your Contact Information and Address Year Gaps

Always explain any gaps in your work history to your advantage.

Key Insights- Employers want to know what you've accomplished, so make sure to explain any gaps using a professional summary.

- Adding extra details and context to explain why you have a gap in your work history shows employers you are a good fit for the position.

How to Optimize Your debt collector Resume

Keep an eye out for these resume traps. Neglecting to detail your job roles or explain gaps in your career can lead to unnecessary doubts. Grammar blunders can reflect negatively on you, and without contact information, how can employers reach you? Be meticulous and complete.

Employment history

- Utilise skip tracin techniqes to locat debtorss

- Prepair report's on collecton activty.

- Perform skipp tracing activites too locate debters.

- Prepear and submite legel documentss for court fillingss.

- Utilise skip tracin techniqes to locat debtorss

- Analysse and reviiew acounts for potential leegal acttion.

Education

Skills

Include Job Descriptions and Avoid Bad Grammar

Avoid sending a wrong first impression by proofreading your resume.

Key Insights- Spelling and typos are the most common mistakes recruiters see in resumes and by simply avoiding them you can move ahead on the hiring process.

- Before submitting your resume, double check to avoid typos.

debt collector Cover Letter Example

A cover letter can be a valuable addition to your job application when applying for an debt collector position. Cover letters provide a concise summary of your qualifications, skills, and experience, also it also gives you an opportunity to explain why you're the best fit for the job. Crafting a cover letter that showcases your relevant experience and enthusiasm for the Accounts Payable role can significantly improve your chances of securing an interview.

Crowe Horwath

Indianapolis, Indiana

To the respected Crowe Horwath Recruitment Team

I am writing to express my interest in the Chief Debt Collector position at Crowe Horwath. As a Debt Collector with 8 years of experience in Accounting & Auditing myself, I believe I have the necessary skills and expertise to excel in this role.

As someone who has always been curious and eager to learn, I have pursued my education and gained experience in areas like Financial Statement Analysis to develop my skills in my work. This experience has given me the opportunity to lead major projects and provide my input in diverse areas, which have helped me gain a deeper understanding of the industry. I am excited to bring my passion and expertise to the role at this company and work towards achieving your organization's goals.

I appreciate the opportunity to apply for the Chief Debt Collector position. I am committed to making a positive impact on the world, so I am thrilled about the opportunity to join your team and work towards achieving our shared goals for the betterment of everyone.

Kind regards,

Kenny Moore

741-770-0717

[email protected]

Kenny Moore

Showcase your most significant accomplishments and qualifications with this cover letter.

Personalize this cover letter in just few minutes with our user-friendly tool!

Related Resumes & Cover Letters

Build your Resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.