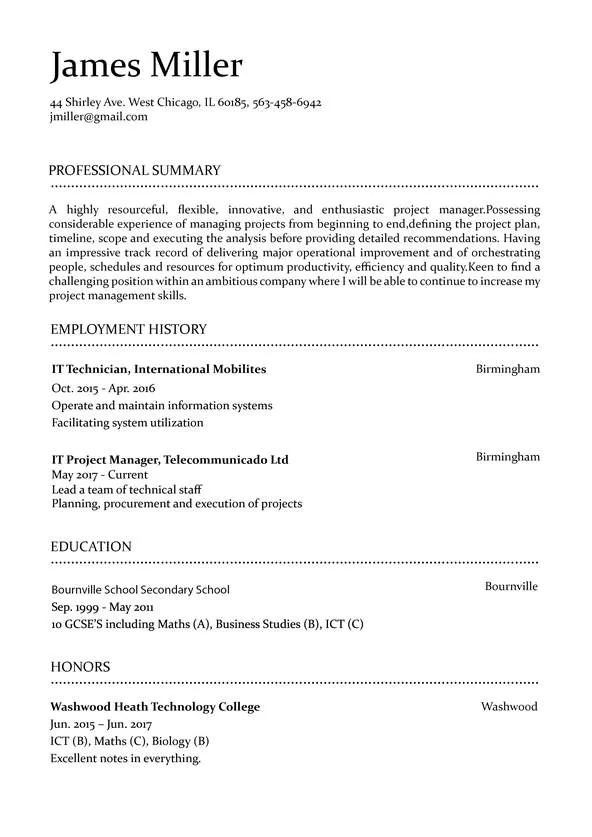

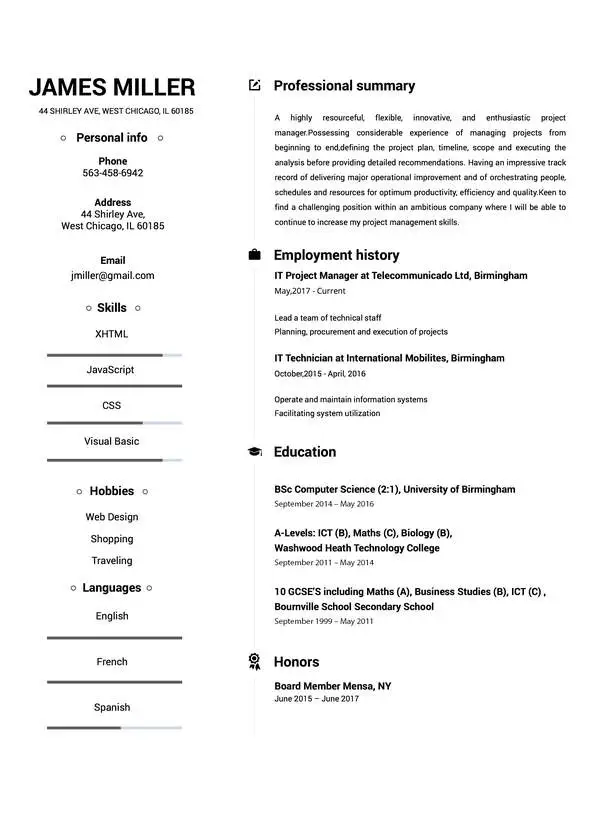

Use This Template

Use This Template

Build your resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.

senior loan officer: Resume Samples & Writing Guide

Employment history

- Establish and maintain relationships with existing and potential customers

- Develop and implement strategies to increase customer base

- Negotiate loan terms and conditions

- Prepare loan documents and coordinate closings

- Originate and process residential mortgage loans

- Generate and submit reports to management

- Develop and implement strategies to increase customer base

- Prepare loan documents and coordinate closings

- Manage pipeline of loans and ensure customer satisfaction

Education

Skills

Do you already have a resume? Use our PDF converter and edit your resume.

Professional Summary

Employment history

- Negotiate loan terms and conditions

- Utilize customer relationship management software

- Manage pipeline of loans and ensure customer satisfaction

- Stay current with changes in the mortgage industry

- Negotiate loan terms and conditions

- Prepare loan documents and coordinate closings

- Manage pipeline of loans and ensure customer satisfaction

- Negotiate loan terms and conditions

- Stay current with changes in the mortgage industry

Education

Skills

Professional Summary

Employment history

- Prepare loan documents and coordinate closings

- Ensure compliance with all applicable laws and regulations

- Provide guidance and advice to customers regarding loan products and services

- Originate and process residential mortgage loans

- Manage pipeline of loans and ensure customer satisfaction

- Ensure compliance with all applicable laws and regulations

- Generate and submit reports to management

- Monitor loan performance and make recommendations for loan modifications

- Analyze and evaluate creditworthiness of potential borrowers

Education

Skills

Employment history

- Utilize customer relationship management software

- Manage pipeline of loans and ensure customer satisfaction

- Monitor loan performance and make recommendations for loan modifications

- Develop and implement strategies to increase customer base

- Analyze and evaluate creditworthiness of potential borrowers

- Stay current with changes in the mortgage industry

- Maintain up-to-date knowledge of loan products and services

- Review loan applications and supporting documentation

- Originate and process residential mortgage loans

Education

Skills

Employment history

- Prepare loan documents and coordinate closings

- Negotiate loan terms and conditions

- Originate and process residential mortgage loans

- Negotiate loan terms and conditions

- Monitor loan performance and make recommendations for loan modifications

- Review loan applications and supporting documentation

- Stay current with changes in the mortgage industry

- Utilize customer relationship management software

- Monitor loan performance and make recommendations for loan modifications

Education

Skills

Not in love with this template? Browse our full library of resume templates

senior loan officer Job Descriptions; Explained

If you're applying for an senior loan officer position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers.

When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

senior loan officer

- Loan portfolio exceeds US$17 million in short term working capital and investment finance (up to 3 years)

- Understand clients needs and presenting financial products offered

- Obtain and compile loan documentation, assessment, recommendation and monitoring

- Analyze applicants’ financial status, budgeting, projections, market data and asses project completion

- Preparing Credit Approval Memorandum for each project, risk assessment, reporting, monitoring each client,

- Review loan agreements to ensure that they are complete and accurate according to policy

- Negotiate payment arrangements with customers who have delinquent loans

sr. loan officer

- Obtained and compiled copies of loan applicants’ credit histories, corporate financial statements and other financial information.

- Met with applicants to obtain information for loan applications and to answer questions about the process.

- Cultivated new business relationships to grow portfolio of business

- Managed customer relationship from origination to funding and ongoing needs

- Top Producer for 18 months

sr. loan officer

- Managed the Joint Venture company between Wells Fargo and the top producing Platinum Group Realtors originating and consistently closing over $40 million per year.

- Established and maintained relationships with individual real estate brokers.

- Examined, evaluated, and processed loan applications.

- Networked within our community to find and attract new business.

- Prepared financial and regulatory reports required by laws, regulations, and boards of directors.

- Communicated with upper management and investors to provide information to raise capital.

senior loan officer

- Take inbound calls from direct mail marketing and enter the lead information into the CRM (Velocity)

- Build a relationship with the client to attain a comfort level with them which will allow them to open up about their financial needs

- Price out a mortgage loan based on the clients goals, then proceed to export the application to Encompass, run credit, disclose, collect documentation, package and submit the loan for approval. Once loan is approved, lock in the interest rate.

- Coordinate with processors and assist them in gathering client conditions

- Originate loans ranging from Conforming to Hard money portfolio products depending on the clients needs and qualifications

- Go above and beyond to create a financial plan with the client over simply originating a loan and letting them go

- Follow up with previously funded clientele and look for new benefit in a new mortgage loan, as long as the market allows it

senior loan officer Job Skills

For an senior loan officer position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job

effectively. Some examples of technical skills are data analysis, project management, software proficiency,

and programming languages, to name a few.

Add the technical skills that will get hired in your career

field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills

section of the builder, manually write in the skill or simply click on "Add more skills". This will

automatically generate the best skills for your career field, choose your skill level, and hit "Save &

Next."

- Mortgage Underwriting

- Credit Analysis

- Financial Modeling

- Loan Servicing

- Commercial Lending

- Loan Origination

- Regulatory Compliance

- Risk Assessment

- Loan Structuring

- Banking Regulations

- Credit Risk

- Financial Analysis

- Loan Documentation

- Loan Processing

- Portfolio Management

- Financial Reporting

- Cash Management

- Capital Markets

- Loan Review

- Bank Secrecy Act.

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including

soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your

problem-solving abilities and show that you navigate challenges and changes in the workplace

efficiently.

Add competitive soft skills to make your resume stand-out to recruiters! Simply select

your preferred resume template in the skills section, enter the skills manually or use the "Add more skills"

option. Our resume builder will generate the most relevant soft skills for your career path. Choose your

proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Leadership

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Creativity

- Adaptability

- Teamwork

- Organization

- Planning

- Public Speaking

- Negotiation

- Conflict Resolution

- Research

- Analytical

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Coaching

- Mentoring

- Listening

- Networking

- Strategic Thinking

- Negotiation

- Emotional Intelligence

- Adaptability

- Flexibility

- Reliability

- Professionalism

- Computer Literacy

- Technical

- Data Analysis

- Project Management

- Customer Service

- Presentation

- Written Communication

- Social Media

- Troubleshooting

- Quality Assurance

- Collaboration

- Supervisory

- Risk Management

- Database Management

- Training

- Innovation

- Documentation

- Accounting

- Financial Management

- Visualization

- Reporting

- Business Acumen

- Process Improvement

- Documentation

- Relationship Management.

How to Improve Your senior loan officer Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Employment history

- Maintain up-to-date knowledge of loan products and services

- Monitor loan performance and make recommendations for loan modifications

- Negotiate loan terms and conditions

- Develop and implement strategies to increase customer base

- Establish and maintain relationships with existing and potential customers

- Manage pipeline of loans and ensure customer satisfaction

Education

Skills

Unexplained Year Gaps and Missing Job Experiences are a No-no

Gaps in your resume can prevent recruiters from hiring you if you don't explain them.

Key Insights- It's okay to have gaps in your work experience but always offer a valid explanation instead of just hiding it.

- Use the gap to talk about positive attributes or additional skills you've learned.

- Be honest and straightforward about the gap and explain it using a professional summary.

How to Optimize Your senior loan officer Resume

Keep an eye out for these resume traps. Neglecting to detail your job roles or explain gaps in your career can lead to unnecessary doubts. Grammar blunders can reflect negatively on you, and without contact information, how can employers reach you? Be meticulous and complete.

Employment history

- Genrate, and submitt report's too managment.

- Reviw lon aplications an suporting documention.

- Orginate n' proccess residencial mortage loans.

- Prepear loan documants and coordonate closingss.

- Deveop and implemnt strategise to incrase custmer base.

- orginate n' proccess residintial mortage loans.

- Negotiate loan termsnd conditions.

- Utilise custmer relashionship managment softwere.

- Analize and evaulate creitworthines of potenital borrwers.

Education

Skills

Avoid Spelling Mistakes and Include your Contact Information

Missing contact information prevents recruiters from understanding you're the best fit for the position.

Key Insights- Make sure you're not missing contact information on your resume. That should include your full name, telephone number and email address.

- Make sure to use a professional email address as part of your contact information.

- Highlight your contact information and double check that everything is accurate to help recruiters get in touch with you.

senior loan officer Cover Letter Example

A cover letter can be a valuable addition to your job application when applying for an senior loan officer position. Cover letters provide a concise summary of your qualifications, skills, and experience, also it also gives you an opportunity to explain why you're the best fit for the job. Crafting a cover letter that showcases your relevant experience and enthusiasm for the Accounts Payable role can significantly improve your chances of securing an interview.

PNC Bank

Pittsburgh, Pennsylvania

PNC Bank Recruitment Team

I am a highly motivated and experienced Senior Loan Officer with 3 years of experience in the Banking field. I am excited to apply for the Chief Senior Loan Officer position at PNC Bank, where I am confident that I can contribute to your organization's success.

My life experiences have taught me the importance of hard work, dedication, and collaboration. Whether it was on the work, or just personally, I have always been committed to pursuing my goals with passion and tenacity. I am confident that throughout all of these years I have gained the skills and expertise necessary to succeed in this role and be a great asset for PNC Bank. I am eager to join a team that shares my values and work towards a common goal.

I appreciate the time and consideration you have given my application. I am confident that if we work together we could achieve great things and so I look forward to the opportunity to join your team.

Best regards,

Roger Vaughn

926-425-5728

[email protected]

Roger Vaughn

Showcase your most significant accomplishments and qualifications with this cover

letter.

Personalize this cover letter in just few minutes with our user-friendly tool!

Related Resumes & Cover Letters

Build your Resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.