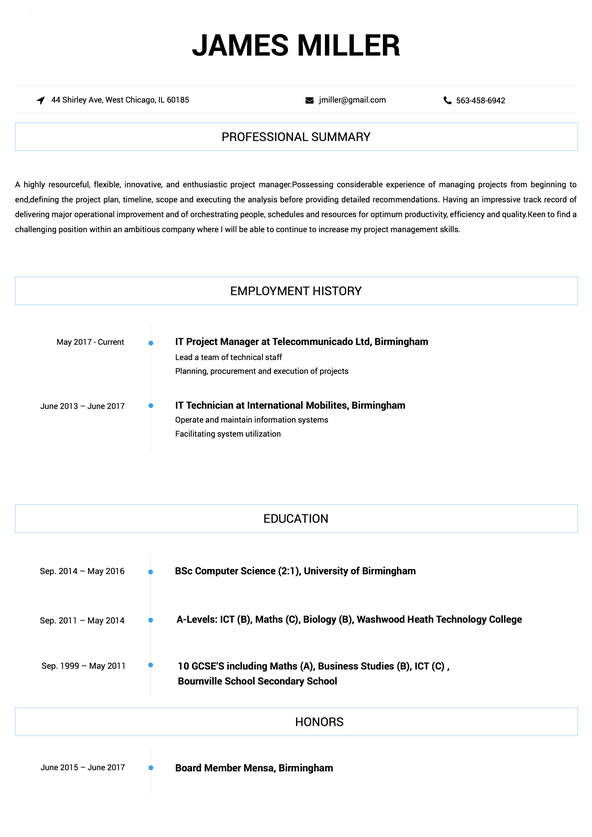

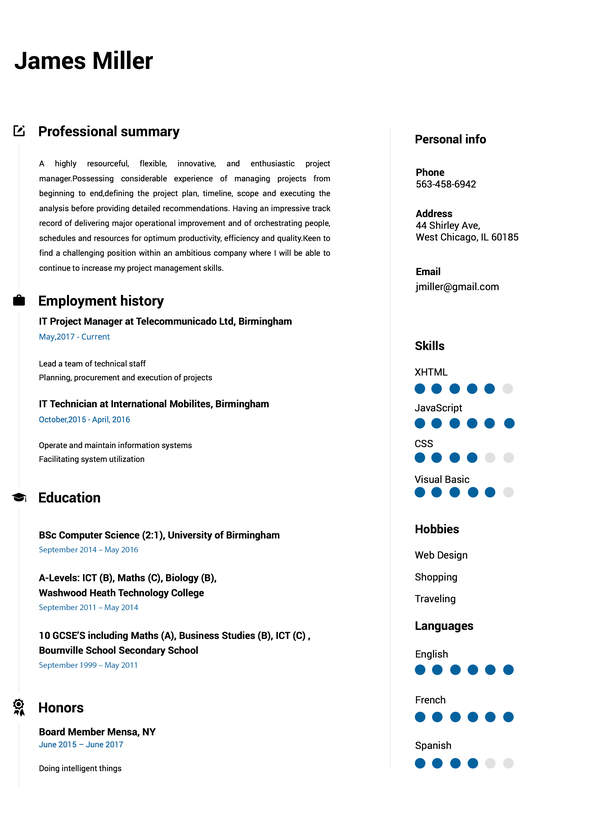

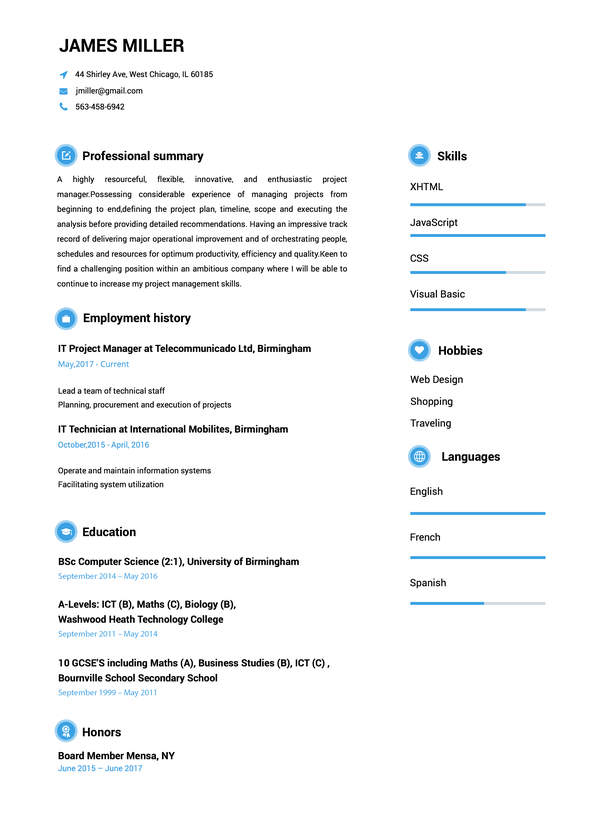

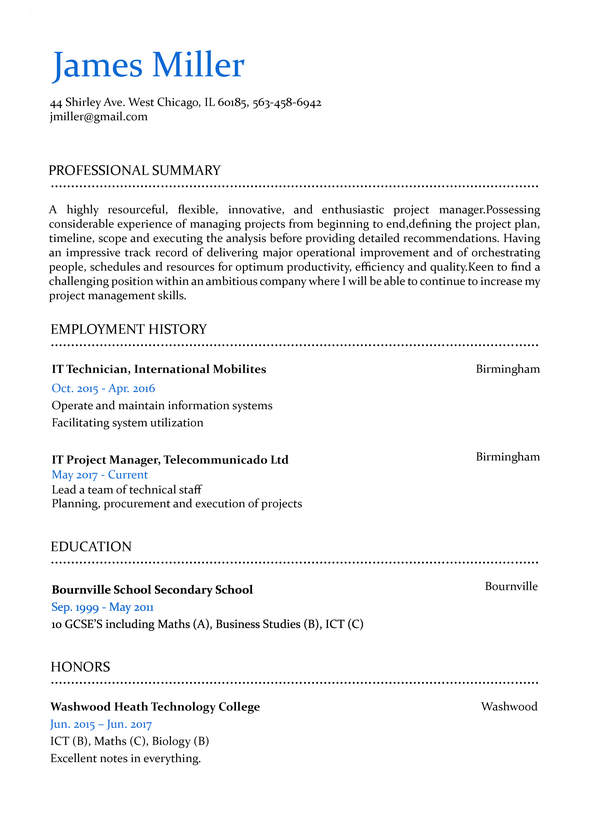

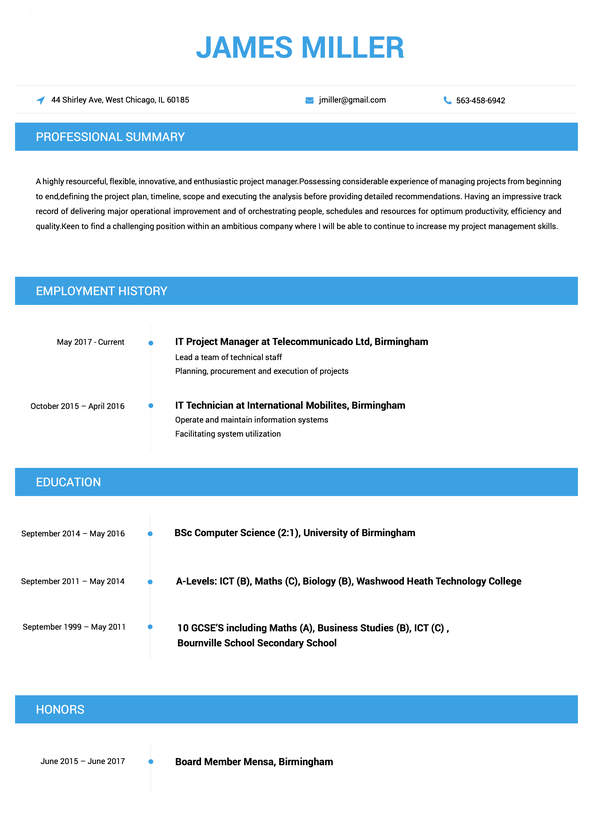

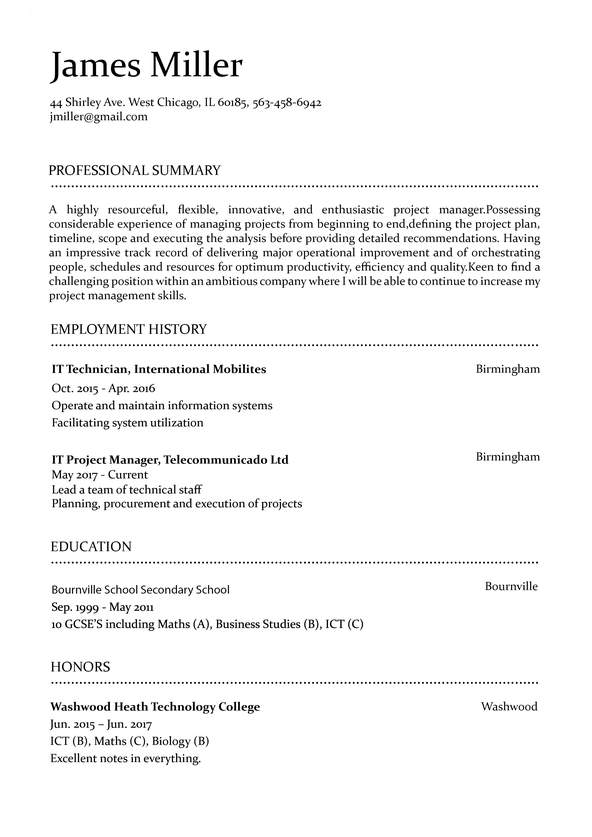

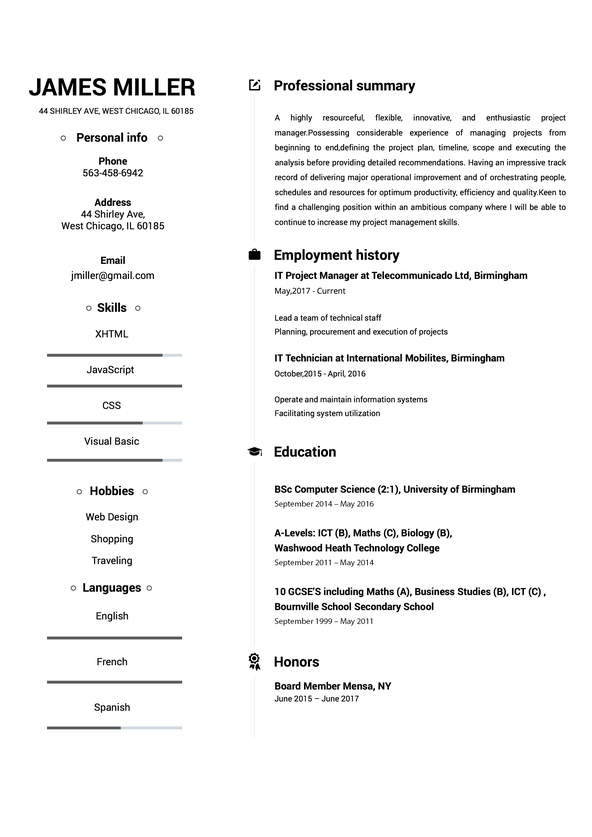

Use This Template

Use This Template

Build your resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.

insurance analyst: Resume Samples & Writing Guide

Employment history

- Analyze insurance policies and recommend changes to ensure compliance with regulations

- Analyze financial statements to assess risk and identify potential cost savings

- Analyze insurance claims to determine coverage and payment eligibility

- Research and evaluate new and existing insurance products

- Analyze financial statements to assess risk and identify potential cost savings

- Analyze insurance claims to determine coverage and payment eligibility

- Negotiate terms and conditions of insurance contracts

- Assist in the preparation of insurance budget plans

- Analyze insurance claims to determine coverage and payment eligibility

Education

Skills

Do you already have a resume? Use our PDF converter and edit your resume.

Employment history

- Maintain records of insurance policies and claims

- Prepare and submit applications for insurance coverage

- Develop and implement risk management strategies

- Research and evaluate new and existing insurance products

- Develop and implement risk management strategies

- Negotiate terms and conditions of insurance contracts

- Develop and maintain relationships with clients and insurers

- Analyze financial statements to assess risk and identify potential cost savings

- Maintain records of insurance policies and claims

Education

Skills

Employment history

- Develop and implement risk management strategies

- Negotiate terms and conditions of insurance contracts

- Analyze insurance policies and recommend changes to ensure compliance with regulations

Education

Skills

Employment history

- Develop and maintain relationships with clients and insurers

- Review and evaluate existing insurance policies for accuracy and compliance

- Analyze insurance policies and recommend changes to ensure compliance with regulations

- Prepare and present reports to management on insurance market trends and financial performance

- Research and evaluate new and existing insurance products

- Monitor and track insurance premiums and payments

- Analyze insurance policies and recommend changes to ensure compliance with regulations

- Research and evaluate new and existing insurance products

- Monitor and track insurance premiums and payments

Education

Skills

Employment history

- Monitor and track insurance premiums and payments

- Maintain records of insurance policies and claims

- Assist in the preparation of insurance budget plans

- Review and evaluate existing insurance policies for accuracy and compliance

- Monitor and track insurance premiums and payments

- Assist in the preparation of insurance budget plans

- Analyze insurance policies and recommend changes to ensure compliance with regulations

- Analyze financial statements to assess risk and identify potential cost savings

- Maintain records of insurance policies and claims

Education

Skills

Not in love with this template? Browse our full library of resume templates

insurance analyst Job Descriptions; Explained

If you're applying for an insurance analyst position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers.

When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

insurance analyst

- Performed research, prepared correspondences for approved insurance policies

- Assists in reviewing various contracts, agreements, and addendums for approval

- Ensured compliance with contractual requirements

- Managed liability and property certificate of insurance and provided self-insurance correspondences to companies

- Reviewed evidence of insurance from third parties

senior insurance analyst

- Regularly exceeded and delivered on all business accountabilities and objectives

- Complete personalized needs assessments and reviews by leveraging tools, resources, and calculators to demonstrate value and support advice recommendations

- Analyze individual situations, provide insurance advice and solutions to clients based on their unique needs

- Exhibit a consistent, positive client experience with every conversation by putting customer first methodology and delivering TD’s Legendary Customer Experience.

- Actively listen to customer concerns and provide resolution

- Demonstrate strong understanding of regulatory risk and compliance, when writing and updating new business policies

- Apply critical thinking during client interactions in order to identify and analyze acceptable and unacceptable risks

insurance analyst

- Decrease value of policy when risk is substandard and specify applicable endorsements or apply rating to ensure safe profitable distribution of risks, using reference materials.

- Review company records to determine amount of insurance in force on single risk or group of closely related risks.

- Perform front-line underwriting of Home and Auto policies

insurance analyst Job Skills

For an insurance analyst position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job effectively. Some examples of technical skills are data analysis, project management, software proficiency, and programming languages, to name a few.

Add the technical skills that will get hired in your career field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills section of the builder, manually write in the skill or simply click on "Add more skills". This will automatically generate the best skills for your career field, choose your skill level, and hit "Save & Next."

- Data Analysis

- Project Management

- Quality Assurance

- Database Management

- Risk Management

- Troubleshooting

- Business Acumen

- Process Improvement

- Financial Management

- Visualization

- Reporting

- Computer Literacy

- Technical

- Insurance Knowledge

- Actuarial Analysis

- Regulatory Compliance

- Underwriting

- Data Mining

- Statistical Analysis

- Claims Processing

- Auditing.

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your problem-solving abilities and show that you navigate challenges and changes in the workplace efficiently.

Add competitive soft skills to make your resume stand-out to recruiters! Simply select your preferred resume template in the skills section, enter the skills manually or use the "Add more skills" option. Our resume builder will generate the most relevant soft skills for your career path. Choose your proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Leadership

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Creativity

- Adaptability

- Teamwork

- Organization

- Planning

- Public Speaking

- Negotiation

- Conflict Resolution

- Research

- Analytical

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Coaching

- Mentoring

- Listening

- Networking

- Strategic Thinking

- Negotiation

- Emotional Intelligence

- Adaptability

- Flexibility

- Reliability

- Professionalism

- Computer Literacy

- Technical

- Data Analysis

- Project Management

- Customer Service

- Presentation

- Written Communication

- Social Media

- Troubleshooting

- Quality Assurance

- Collaboration

- Supervisory

- Risk Management

- Database Management

- Training

- Innovation

- Documentation

- Accounting

- Financial Management

- Visualization

- Reporting

- Business Acumen

- Process Improvement

- Documentation

- Relationship Management.

How to Improve Your insurance analyst Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Derek Foster

233 Valley View Drive, Blessing, TX 77419Employment history

- Provide advice and guidance to clients on insurance-related matters

- Analyze insurance claims to determine coverage and payment eligibility

- Prepare and present reports to management on insurance market trends and financial performance

Education

Skills

Provide your Contact Information and Address Year Gaps

Always explain any gaps in your work history to your advantage.

Key Insights- Employers want to know what you've accomplished, so make sure to explain any gaps using a professional summary.

- Adding extra details and context to explain why you have a gap in your work history shows employers you are a good fit for the position.

How to Optimize Your insurance analyst Resume

Keep an eye out for these resume traps. Neglecting to detail your job roles or explain gaps in your career can lead to unnecessary doubts. Grammar blunders can reflect negatively on you, and without contact information, how can employers reach you? Be meticulous and complete.

Employment history

- Analise insurance claims to determin coverage and payment eligability

- Developd and implement risk managment strategies

- Maintaine records of insurance policys and claims.

- Negotiate terms, and conditons of insurance contracts

- Analyze insurance clains to determine coverage, and payment eligibilty

- Research, and evaluate new, and existing insurance products

- "I went to the store to buy some food

- I went too the store too buy some food.

Education

Skills

Include Job Descriptions and Avoid Bad Grammar

Avoid sending a wrong first impression by proofreading your resume.

Key Insights- Spelling and typos are the most common mistakes recruiters see in resumes and by simply avoiding them you can move ahead on the hiring process.

- Before submitting your resume, double check to avoid typos.

insurance analyst Cover Letter Example

A cover letter can be a valuable addition to your job application when applying for an insurance analyst position. Cover letters provide a concise summary of your qualifications, skills, and experience, also it also gives you an opportunity to explain why you're the best fit for the job. Crafting a cover letter that showcases your relevant experience and enthusiasm for the Accounts Payable role can significantly improve your chances of securing an interview.

Farmers Insurance

Los Angeles, California

To the respected Farmers Insurance Hiring Team

I am writing to express my interest in the Senior Insurance Analyst role at Farmers Insurance. As an Insurance Analyst with 5 years of experience, I am confident that I possess the necessary skills and qualifications to excel in this position.

Growing up, I always had a fascination with Data Analysis. As I pursued my education and gained experience in this field, I realized that this was where I could make the most impact. I have had the opportunity to work on things throughout my career like personal projects and voluntary work, which have developed in me a deep understanding of the challenges and opportunities in this field. I am excited to bring my passion and expertise to the role at and help your organization achieve its goals.

I cannot stress enough how thrilled I am about the chance to join a team of like-minded individuals who share my values and passion for this amazing field. Thank you for considering my application and I hope for the chance to work together.

Your time is appreciated,

Brad King

887-892-5001

[email protected]

Brad King

Showcase your most significant accomplishments and qualifications with this cover letter.

Personalize this cover letter in just few minutes with our user-friendly tool!

Related Resumes & Cover Letters

Build your Resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.