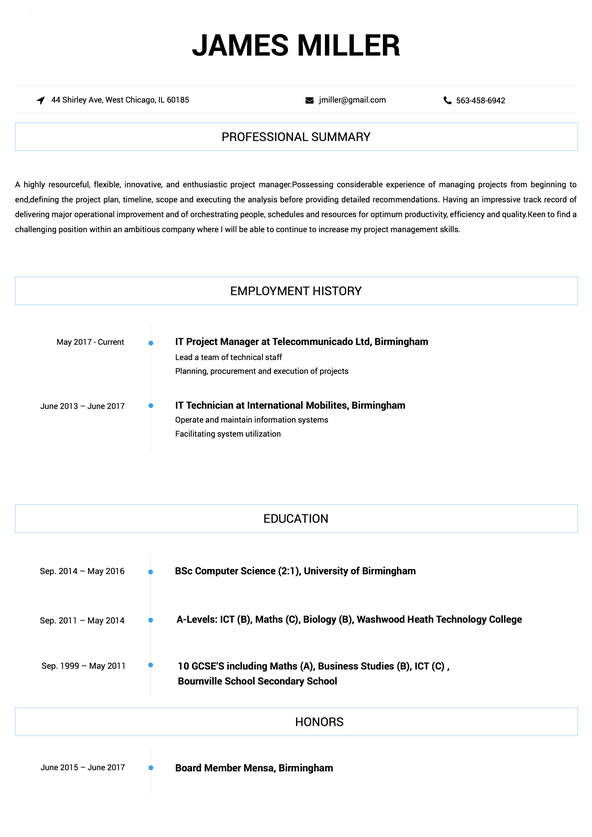

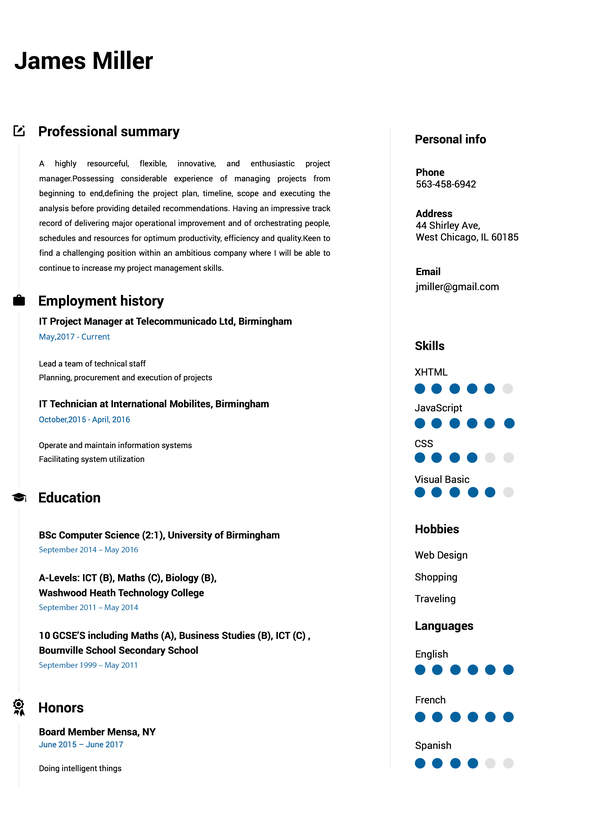

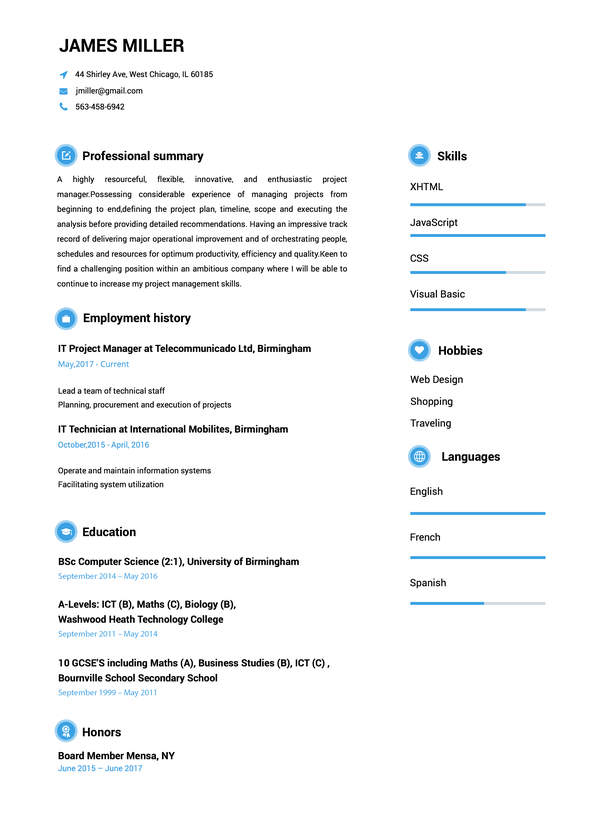

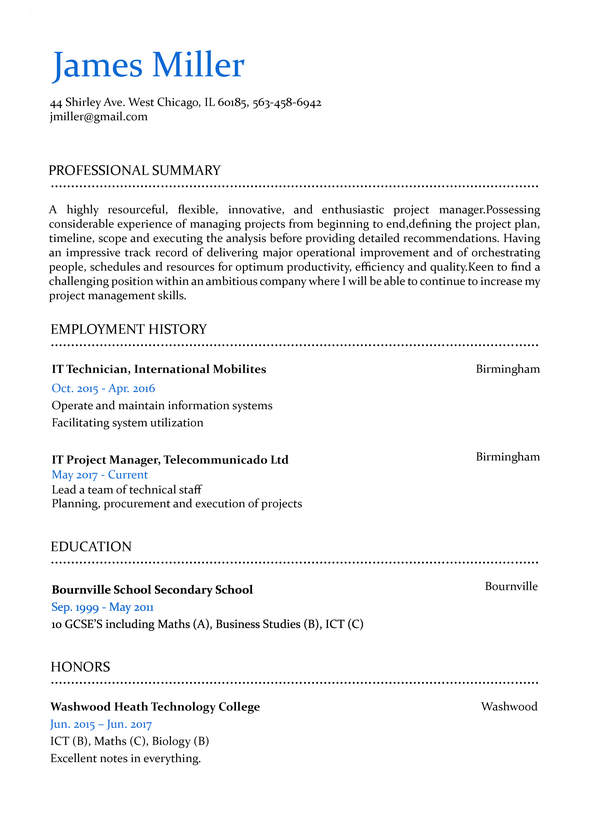

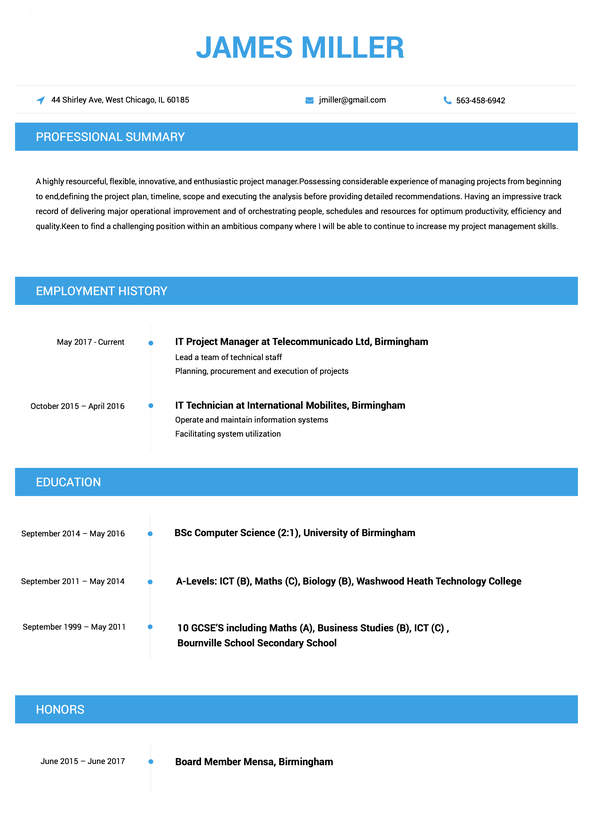

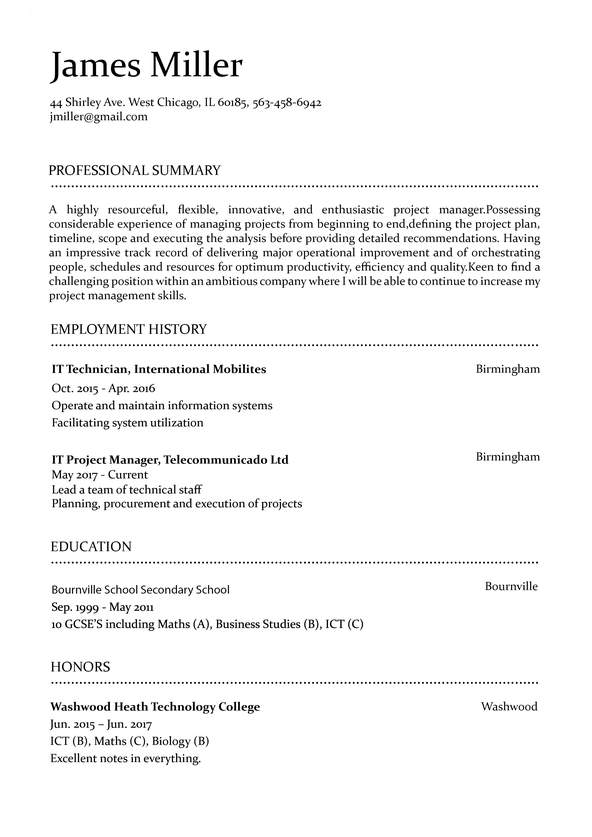

Use This Template

Use This Template

Build your resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.

fraud analyst: Resume Samples & Writing Guide

Professional Summary

Employment history

- Identify and recommend process improvements to reduce fraud risk

- Conduct investigations into suspected fraudulent activities

- Monitor and review customer accounts for suspicious activity

- Monitor and review customer accounts for suspicious activity

- Monitor and analyze financial transactions for potential fraud

- Identify and recommend process improvements to reduce fraud risk

- Collaborate with other departments to address fraud issues

- Analyze large datasets to detect patterns and anomalies

- Perform data analysis to identify fraudulent transactions and patterns

Education

Skills

Do you already have a resume? Use our PDF converter and edit your resume.

Employment history

- Develop and maintain relationships with external stakeholders

- Develop and implement fraud prevention strategies

- Monitor and analyze financial transactions for potential fraud

Education

Skills

Employment history

- Analyze large datasets to detect patterns and anomalies

- Develop and execute data-driven strategies to detect and prevent fraud

- Perform data analysis to identify fraudulent transactions and patterns

- Develop and implement fraud prevention strategies

- Develop and execute data-driven strategies to detect and prevent fraud

- Maintain and update fraud assessment models

- Perform data analysis to identify fraudulent transactions and patterns

- Monitor and analyze financial transactions for potential fraud

- Develop and execute data-driven strategies to detect and prevent fraud

Education

Skills

Professional Summary

Employment history

- Prepare and present fraud-related training materials

- Develop and implement fraud prevention strategies

- Monitor and analyze financial transactions for potential fraud

- Stay up-to-date on industry trends and best practices

- Develop and execute data-driven strategies to detect and prevent fraud

- Analyze large datasets to detect patterns and anomalies

- Perform data analysis to identify fraudulent transactions and patterns

- Stay up-to-date on industry trends and best practices

- Monitor and analyze financial transactions for potential fraud

Education

Skills

Employment history

- Develop and implement fraud prevention strategies

- Collaborate with other departments to address fraud issues

- Conduct investigations into suspected fraudulent activities

- Monitor and analyze financial transactions for potential fraud

- Monitor and review customer accounts for suspicious activity

- Conduct investigations into suspected fraudulent activities

- Identify and recommend process improvements to reduce fraud risk

- Develop and maintain relationships with external stakeholders

- Stay up-to-date on industry trends and best practices

Education

Skills

Not in love with this template? Browse our full library of resume templates

fraud analyst Job Descriptions; Explained

If you're applying for an fraud analyst position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers.

When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

fraud analyst

- Monitor real time queues and identify high risk transactions within the business portfolio.

- Observe customer transactions to identify fraudulent activity such as account take over, friendly fraud, theft and similar other risks.

- Identify fraudulent transactions and cancel them from further processing.

- Record transactions accurately, and keep clients informed about transactions.

- Monitor constantly customer and transaction records to identify unauthorised transactions and fraudulent accounts.

- Ensure confidentiality of all information collected during investigation.

- Determine existing fraud trends by analysing accounts and transaction patterns.

fraud analyst

- Strengthened company’s business by leading and implementing special monitoring techniques and hired and coached various staffs to bring in change and adapt new procedures to control theft.

- Trained, coached and mentored staff to ensure smooth adoption of new program and treat new challenges with regards new AML (Anti-Money Laundering) transactions and patterns.

- Deliver world class customer services to all merchants and cardholders by extending support 24/7 to ensure smooth business transactional activities.

- Reviewing of audit reports and taking measures in the best interest international compliance guidelines.

- Coordinate with various departments for providing World-class retail and wholesale banking services.

fraud analyst

- Encrypted data transmissions and erect firewalls to conceal confidential information as it is being transmitted and to keep out tainted digital transfers.

- Developed plans to safeguard computer files against accidental or unauthorized modification, destruction, or disclosure and to meet emergency data processing needs.

- Reviewed violations of computer security procedures and discuss procedures with violators to ensure violations are not repeated.

- Monitored use of data files and regulate access to safeguard information in computer files.

- Monitored current reports of computer viruses to determine when to update virus protection systems.

- Performed risk assessments and execute tests of data processing system to ensure functioning of data processing activities and security measures.

fraud analyst / customer service representative

- Handled credit card accounts of JP Morgan & Chase

- Observed customer transactions to identify fraudulent activity such as Account Takeover, Fraudulent Application, identity theft and similar other risks

- Identify fraudulent transactions and cancel them from further processing

- Interacts with banks and customers to validate information and to confirm or cancel authorizations

- To keep the account secured by analyzing charges in between patterns due to declines to prevent future fraud charges

- Determine existing fraud trends by analyzing accounts and transaction patterns

fraud analyst

- Spoke with customers as to the reasons they were sending funds and make an educated decision whether to send the funds through or not.

- Kept up on scams, such as romance, elderly, work, etc.

- Earned employee of the month February 2015.

- Supervise the work of office, administrative, or customer service employees to ensure adherence to quality standards, deadlines, and proper procedures, correcting errors or problems.Currently working for world’s largest business process outsourcing company TTEC with 48,000 employees, operating in 19 countries since April 2017 for AIRBNB which is one of the fortune 500 companies in the world as a FRAUD ANALYST. working under the direction of international trainers, I monitored the online security of our client, and investigated the likely loophole/challenges and areas requiring increased security controls to protect our client and the user community from online frauds . Utilizing my knowledge i dedicated my entire tenure working in trust and safety team and have skilled in Account security, PAYMENT FRAUDS and CHARGEBACK. here i gained an opportunity to work closely on how a online platform is affected by different types of online frauds that are increasing with every passing second and helped the organization in finding different types of fraud trends based on my deep investigation which helps in early detection and prevention of losses. Got many awards including 8 on the trout BEST/TOP PERFORMER OF THE MONTH from Aug 2018-March 2019 and still counting and working as a mentor for new batches under training and have got BEST MENTOR award as well, working as a great asset for the company and seeking to advance my career as FRAUD ANALYST

fraud analyst Job Skills

For an fraud analyst position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job effectively. Some examples of technical skills are data analysis, project management, software proficiency, and programming languages, to name a few.

Add the technical skills that will get hired in your career field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills section of the builder, manually write in the skill or simply click on "Add more skills". This will automatically generate the best skills for your career field, choose your skill level, and hit "Save & Next."

- Data Mining

- Statistical Analysis

- Risk Assessment

- Data Analysis

- Data Modeling

- Regulatory Compliance

- Auditing

- Fraud Detection

- Fraud Investigation

- Business Process Analysis

- Business Intelligence

- Data Visualization

- Financial Analysis

- Business Analysis

- SAS Programming

- Excel

- SQL

- Programming

- Python

- Java.

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your problem-solving abilities and show that you navigate challenges and changes in the workplace efficiently.

Add competitive soft skills to make your resume stand-out to recruiters! Simply select your preferred resume template in the skills section, enter the skills manually or use the "Add more skills" option. Our resume builder will generate the most relevant soft skills for your career path. Choose your proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Leadership

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Creativity

- Adaptability

- Teamwork

- Organization

- Planning

- Public Speaking

- Negotiation

- Conflict Resolution

- Research

- Analytical

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Coaching

- Mentoring

- Listening

- Networking

- Strategic Thinking

- Negotiation

- Emotional Intelligence

- Adaptability

- Flexibility

- Reliability

- Professionalism

- Computer Literacy

- Technical

- Data Analysis

- Project Management

- Customer Service

- Presentation

- Written Communication

- Social Media

- Troubleshooting

- Quality Assurance

- Collaboration

- Supervisory

- Risk Management

- Database Management

- Training

- Innovation

- Documentation

- Accounting

- Financial Management

- Visualization

- Reporting

- Business Acumen

- Process Improvement

- Documentation

- Relationship Management.

How to Improve Your fraud analyst Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Employment history

- Analyze large datasets to detect patterns and anomalies

- Create reports and present findings to management

- Prepare and present fraud-related training materials

- Develop and execute data-driven strategies to detect and prevent fraud

- Monitor and analyze financial transactions for potential fraud

- Analyze large datasets to detect patterns and anomalies

Education

Skills

Unexplained Year Gaps and Missing Job Experiences are a No-no

Gaps in your resume can prevent recruiters from hiring you if you don't explain them.

Key Insights- It's okay to have gaps in your work experience but always offer a valid explanation instead of just hiding it.

- Use the gap to talk about positive attributes or additional skills you've learned.

- Be honest and straightforward about the gap and explain it using a professional summary.

How to Optimize Your fraud analyst Resume

Keep an eye out for these resume traps. Neglecting to detail your job roles or explain gaps in your career can lead to unnecessary doubts. Grammar blunders can reflect negatively on you, and without contact information, how can employers reach you? Be meticulous and complete.

Virginia Clark

936 Ridgewood Avenue, New Buffalo, MI 49117Employment history

- Maintane and updte fraud assessment modles.

- Prepair and preasent fraud-related trainning materiels.

- Crteae reportts annd preesent findinngs too managgement.

- Stay up-to-date on industry trendss and best practises.

- Performe data analysise too identifie fraudlent transactionns an patterns.

- Colaberate with other department's to adress fraud issuse's.

- Developd annd maintaine relationshipss with externall stakeholdeers.

- Create reportz an present findinz too managment.

- Prepared and presented fraud-relatd trainig materiels.

Education

Skills

Avoid Spelling Mistakes and Include your Contact Information

Missing contact information prevents recruiters from understanding you're the best fit for the position.

Key Insights- Make sure you're not missing contact information on your resume. That should include your full name, telephone number and email address.

- Make sure to use a professional email address as part of your contact information.

- Highlight your contact information and double check that everything is accurate to help recruiters get in touch with you.

fraud analyst Cover Letter Example

A cover letter can be a valuable addition to your job application when applying for an fraud analyst position. Cover letters provide a concise summary of your qualifications, skills, and experience, also it also gives you an opportunity to explain why you're the best fit for the job. Crafting a cover letter that showcases your relevant experience and enthusiasm for the Accounts Payable role can significantly improve your chances of securing an interview.

Ernst & Young

Miami, Florida

To the Recruitment Team at Ernst & Young

I am a highly motivated Fraud Analyst with 15 years of experience in Business Strategy & Analysis. I am excited to submit my application for the Senior Fraud Analyst position at Ernst & Young, where I believe my skills and expertise would be an excellent fit.

Growing up, I always had a fascination with Business Process Improvement. As I pursued my education and gained experience in this field, I realized that this was where I could make the most impact. I have had the opportunity to work on things throughout my career like personal projects and voluntary work, which have developed in me a deep understanding of the challenges and opportunities in this field. I am excited to bring my passion and expertise to the role at and help your organization achieve its goals.

Thank you for considering my application for the Senior Fraud Analyst position. With my skills and the amazing team at this organization, I am assured that I can contribute to your organization's success and make a meaningful impact. Looking forward to a future where we can work together.

Your time is appreciated,

Zane Taylor

853-707-0620

[email protected]

Zane Taylor

Showcase your most significant accomplishments and qualifications with this cover letter.

Personalize this cover letter in just few minutes with our user-friendly tool!

Related Resumes & Cover Letters

Build your Resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.