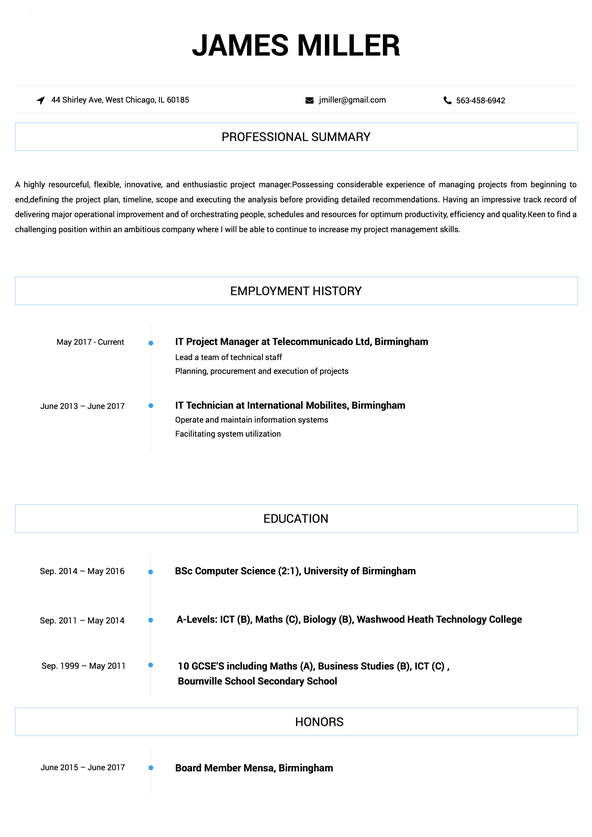

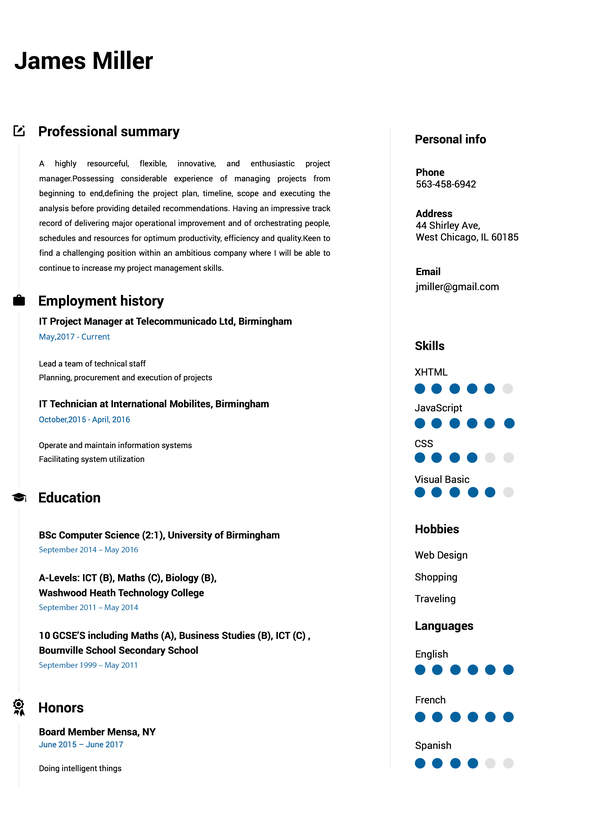

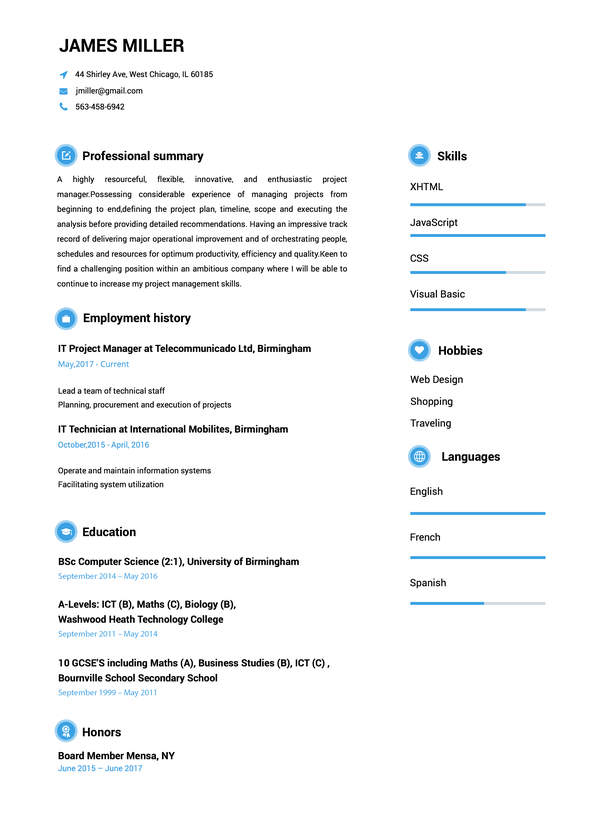

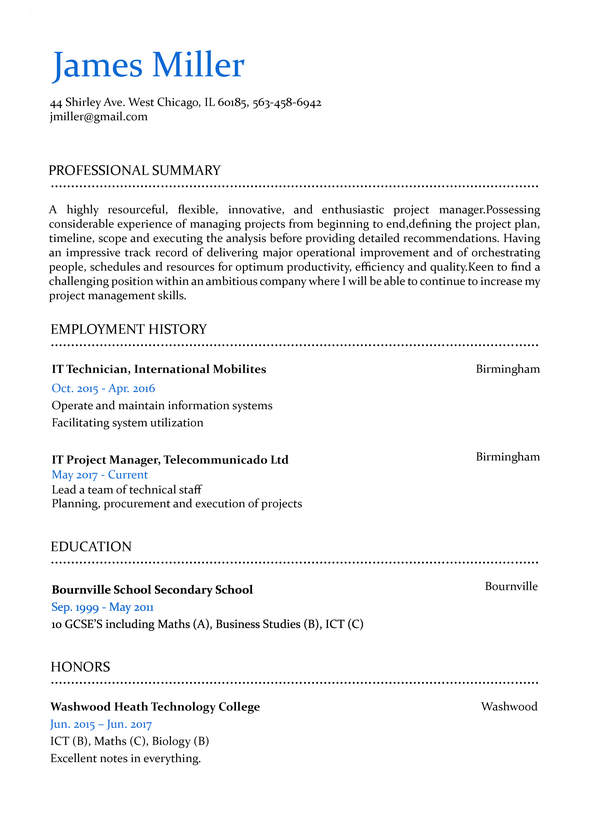

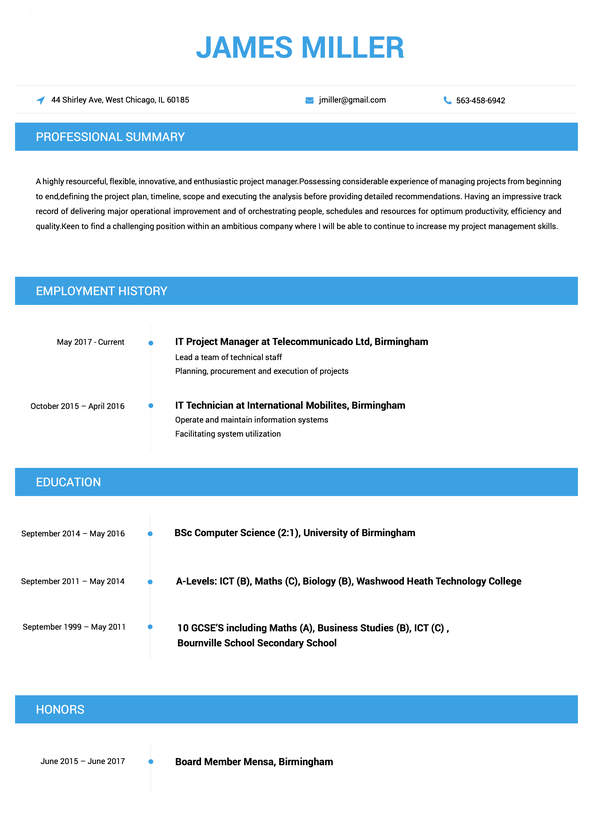

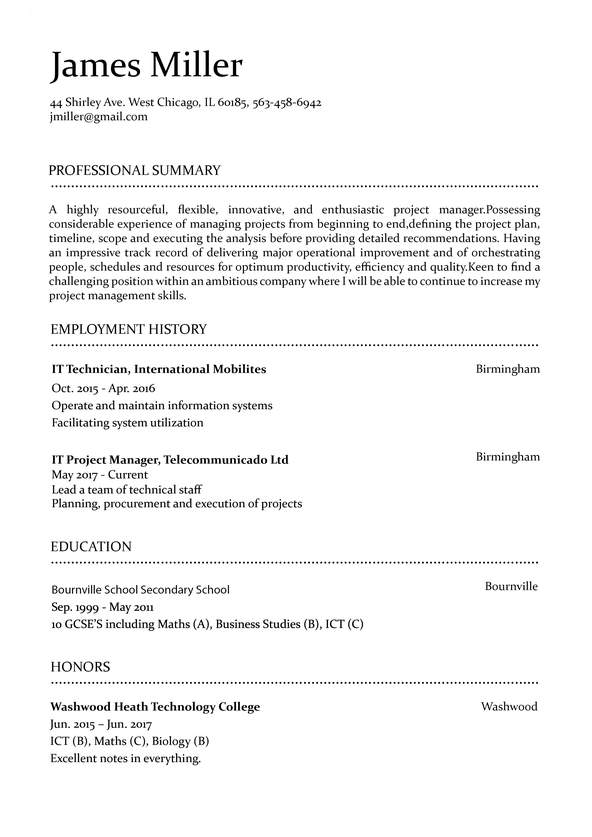

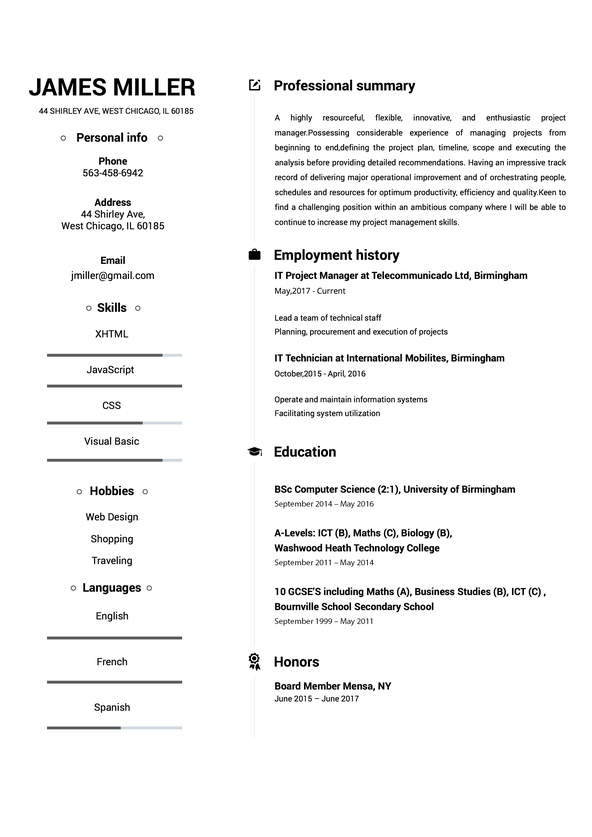

Use This Template

Use This Template

Build your resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.

cost accountant: Resume Samples & Writing Guide

Professional Summary

Employment history

- Assist in implementing new accounting and cost procedures

- Perform cost analyses and cost-benefit analyses

- Analyze financial data and generate financial reports

- Assist in implementing new accounting and cost procedures

- Analyze changes in product design, raw materials, manufacturing methods, or services provided, to determine effects on cost

- Analyze actual manufacturing costs and prepare periodic reports comparing standard costs to actual production costs

- Analyze changes in product design, raw materials, manufacturing methods, or services provided, to determine effects on cost

- Monitor and review the performance of cost accounting systems

- Prepare and analyze budgets, financial statements, and other reports

Education

Skills

Do you already have a resume? Use our PDF converter and edit your resume.

Professional Summary

Employment history

- Prepare financial and operational reports

- Analyze actual manufacturing costs and prepare periodic reports comparing standard costs to actual production costs

- Perform cost analyses and cost-benefit analyses

- Analyze financial data and generate financial reports

- Participate in the annual audit process

- Analyze actual costs and prepare periodic reports comparing standard costs to actual production costs

- Participate in the annual audit process

- Perform cost analyses and cost-benefit analyses

- Assist in implementing new accounting and cost procedures

Education

Skills

Professional Summary

Employment history

- Establish and maintain cost accounting systems and procedures

- Analyze actual costs and prepare periodic reports comparing standard costs to actual production costs

- Prepare financial and operational reports

- Perform cost analyses and cost-benefit analyses

- Analyze and report on variances between actual and expected costs

- Assist in implementing new accounting and cost procedures

- Develop and maintain cost accounting and inventory systems

- Analyze and report on variances between actual and expected costs

- Perform cost analyses and cost-benefit analyses

Education

Skills

Professional Summary

Employment history

- Analyze financial data and generate financial reports

- Analyze actual manufacturing costs and prepare periodic reports comparing standard costs to actual production costs

- Monitor and review the performance of cost accounting systems

- Assist in month-end and year-end closing

- Analyze financial data and generate financial reports

- Perform cost analyses and cost-benefit analyses

- Assist in implementing new accounting and cost procedures

- Establish and maintain cost accounting systems and procedures

- Assist in month-end and year-end closing

Education

Skills

Employment history

- Prepare cost estimates and budgets

- Monitor and review the performance of cost accounting systems

- Prepare and analyze budgets, financial statements, and other reports

- Prepare financial and operational reports

- Analyze actual manufacturing costs and prepare periodic reports comparing standard costs to actual production costs

- Participate in the annual audit process

- Analyze and report on variances between actual and expected costs

- Analyze actual manufacturing costs and prepare periodic reports comparing standard costs to actual production costs

- Prepare and analyze budgets, financial statements, and other reports

Education

Skills

Not in love with this template? Browse our full library of resume templates

cost accountant Job Descriptions; Explained

If you're applying for an cost accountant position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers.

When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

cost accountant

- Approve all accounting voucher entries and match automated sheets with manual voucher entries.

- Check and reconcile the inventory system.

- Prepare letters of credit cost accounting, perform all costing accountancy (Production Reports & Distribution) procedures for all cost centres.

- Issue transfer letters & follow up with banks & suppliers to get confirmations.

- Coordinate in the sales tax auditing reporting.

- Prepare reconciliation with all of account receivable and accounts payable.

- Prepare trial balances with full details for yearly balance sheet.

cost accountant

- Do costings for new products and existing products using the Amaro Foods Costing Module

- Make sure prices are up to date and Supplier Contract Prices are correct

- Conduct physical count of the inventory at end of the year.

- Responsible for payroll.

cost accountant

- Handled Cost Audit Reports and Accounts of Automobile and Textile Industries.

- Prepared CAS-4 Reports and handled related matters thereto.

- Prepared Compliance Certificates and filed MCA forms.

- Costing of the manufacturing process of Springs in Akal Spring Company.

- Managed and prepared board resolutions at Nexo Industries.

cost accountant

- Full control of monthly stock takes.

- Problem solving on the day.

- Stock variance analysis and interpretation.

- Loading of new products and maintaining of bills of material.

- Labour and overhead updates on a weekly basis.

- Product cost reporting.

cost accountant

- Standard Cost Calculation base on bill of materials provided by technology department and logisticst deparment, ensure the correct cost calculation.

- Fixed asses depreciation calculation

- Budget and Forecast elaboration

- Invoicing products to customers reviwing price, volume and mix comparing with forecast and budget numbers

- Physicali inventory coordination

- Month end activities

- Expeses analysis

cost accountant Job Skills

For an cost accountant position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job effectively. Some examples of technical skills are data analysis, project management, software proficiency, and programming languages, to name a few.

Add the technical skills that will get hired in your career field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills section of the builder, manually write in the skill or simply click on "Add more skills". This will automatically generate the best skills for your career field, choose your skill level, and hit "Save & Next."

- Cost Accounting

- Budgeting

- Cost Analysis

- Variance Analysis

- Financial Analysis

- Internal Control

- Internal Auditing

- Financial Modeling

- Financial Forecasting

- Accounts Payable

- Accounts Receivable

- Tax Preparation

- Internal Reporting

- Cash Flow Management

- Inventory Management

- Financial Planning

- GAAP Compliance

- Variance Reporting

- Reconciliation

- Sarbanes-Oxley Compliance

- Bank Reconciliation.

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your problem-solving abilities and show that you navigate challenges and changes in the workplace efficiently.

Add competitive soft skills to make your resume stand-out to recruiters! Simply select your preferred resume template in the skills section, enter the skills manually or use the "Add more skills" option. Our resume builder will generate the most relevant soft skills for your career path. Choose your proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Leadership

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Creativity

- Adaptability

- Teamwork

- Organization

- Planning

- Public Speaking

- Negotiation

- Conflict Resolution

- Research

- Analytical

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Coaching

- Mentoring

- Listening

- Networking

- Strategic Thinking

- Negotiation

- Emotional Intelligence

- Adaptability

- Flexibility

- Reliability

- Professionalism

- Computer Literacy

- Technical

- Data Analysis

- Project Management

- Customer Service

- Presentation

- Written Communication

- Social Media

- Troubleshooting

- Quality Assurance

- Collaboration

- Supervisory

- Risk Management

- Database Management

- Training

- Innovation

- Documentation

- Accounting

- Financial Management

- Visualization

- Reporting

- Business Acumen

- Process Improvement

- Documentation

- Relationship Management.

How to Improve Your cost accountant Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Jeff Moore

732 Forest St., Sidney, IN 46510Employment history

- Analyze actual manufacturing costs and prepare periodic reports comparing standard costs to actual production costs

- Perform cost analyses and cost-benefit analyses

- Prepare cost estimates and budgets

- Prepare financial and operational reports

- Perform cost analyses and cost-benefit analyses

- Analyze changes in product design, raw materials, manufacturing methods, or services provided, to determine effects on cost

- Assist in implementing new accounting and cost procedures

- Participate in the annual audit process

- Prepare and analyze budgets, financial statements, and other reports

Education

Skills

Provide your Contact Information and Address Year Gaps

Always explain any gaps in your work history to your advantage.

Key Insights- Employers want to know what you've accomplished, so make sure to explain any gaps using a professional summary.

- Adding extra details and context to explain why you have a gap in your work history shows employers you are a good fit for the position.

How to Optimize Your cost accountant Resume

Keep an eye out for these resume traps. Neglecting to detail your job roles or explain gaps in your career can lead to unnecessary doubts. Grammar blunders can reflect negatively on you, and without contact information, how can employers reach you? Be meticulous and complete.

Professional Summary

Employment history

- Prepair financial and operational report's

- Analyse and report on variance's between actual and expected cost's

- Assist in month-end and year-end closin'

- Prepair cost estamates and budgtes

- Esablish and maintian cost accounting systems and proceduers

- Assit in month-end and year-end closin

- "I went to the store to buy some groceries

- I went too the store to buy some grocerys.

Education

Skills

Include Job Descriptions and Avoid Bad Grammar

Avoid sending a wrong first impression by proofreading your resume.

Key Insights- Spelling and typos are the most common mistakes recruiters see in resumes and by simply avoiding them you can move ahead on the hiring process.

- Before submitting your resume, double check to avoid typos.

cost accountant Cover Letter Example

A cover letter can be a valuable addition to your job application when applying for an cost accountant position. Cover letters provide a concise summary of your qualifications, skills, and experience, also it also gives you an opportunity to explain why you're the best fit for the job. Crafting a cover letter that showcases your relevant experience and enthusiasm for the Accounts Payable role can significantly improve your chances of securing an interview.

McGladrey

Minneapolis, Minnesota

McGladrey Recruitment Team

I am a highly motivated Cost Accountant with 12 years of experience in Accounting & Auditing. I am excited to submit my application for the Chief Cost Accountant position at McGladrey, where I believe my skills and expertise would be an excellent fit.

As someone who has always been curious and eager to learn, I have pursued my education and gained experience in areas like Tax Planning to develop my skills in my work. This experience has given me the opportunity to lead major projects and provide my input in diverse areas, which have helped me gain a deeper understanding of the industry. I am excited to bring my passion and expertise to the role at this company and work towards achieving your organization's goals.

Thank you for considering my application for the Chief Cost Accountant position. With my skills and the amazing team at this organization, I am assured that I can contribute to your organization's success and make a meaningful impact. Looking forward to a future where we can work together.

Kind regards,

Yolie Irving

979-259-4321

[email protected]

Yolie Irving

Showcase your most significant accomplishments and qualifications with this cover letter.

Personalize this cover letter in just few minutes with our user-friendly tool!

Related Resumes & Cover Letters

Build your Resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.