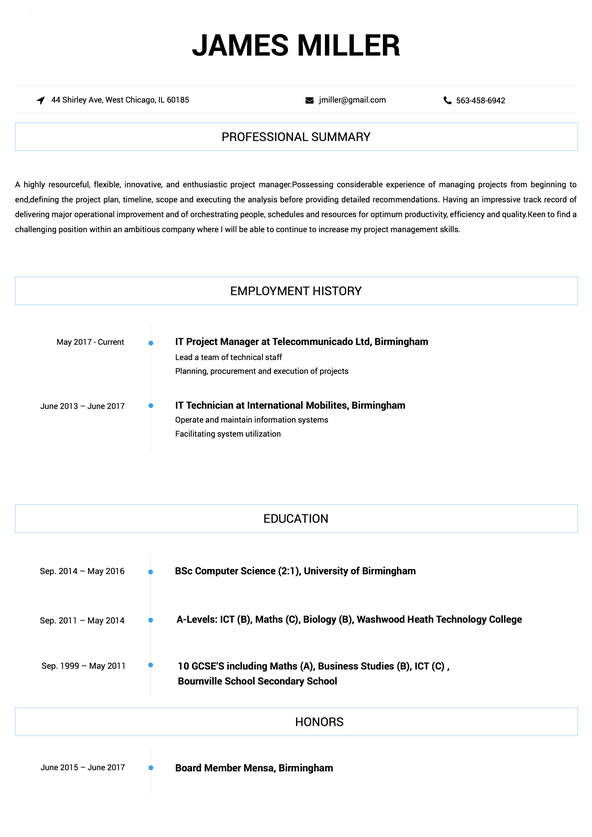

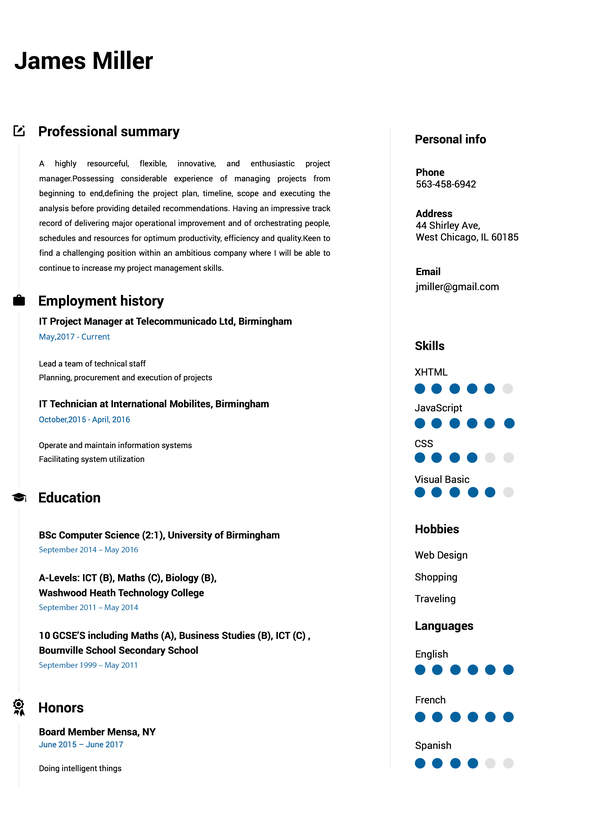

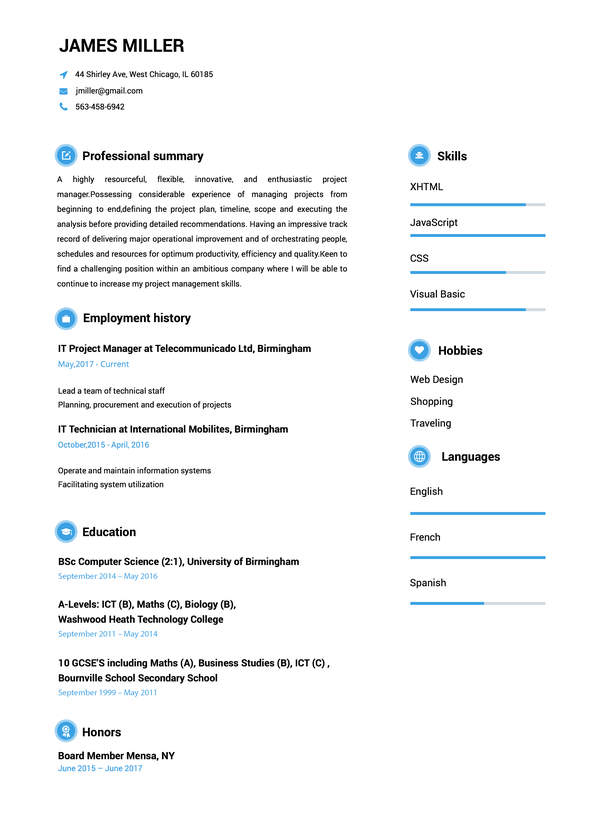

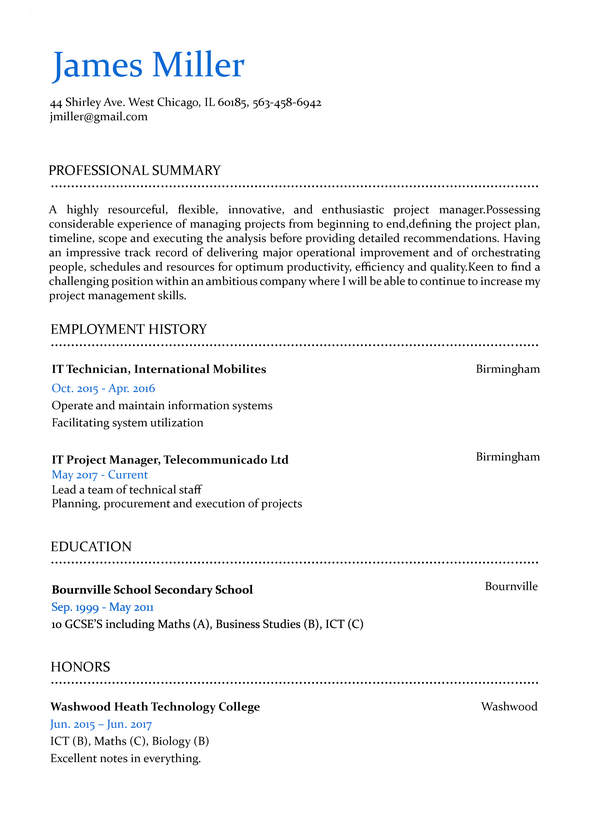

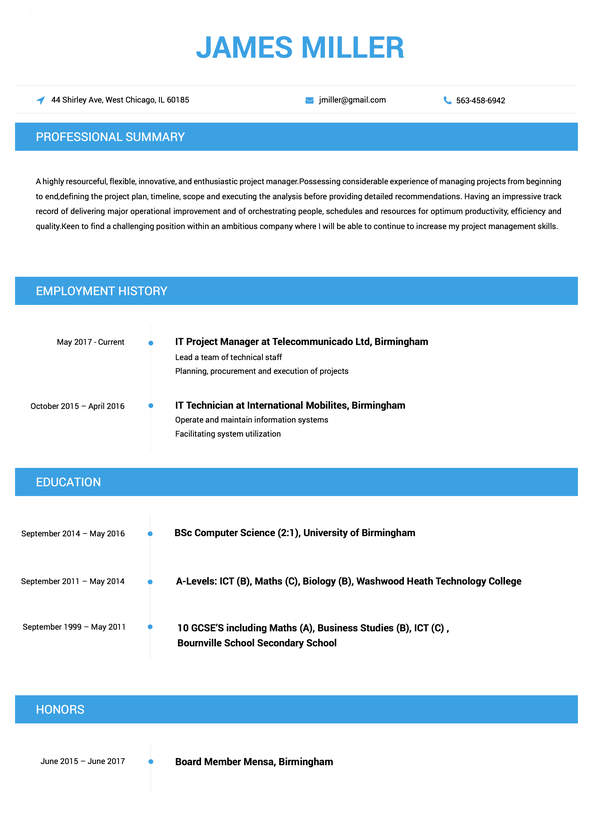

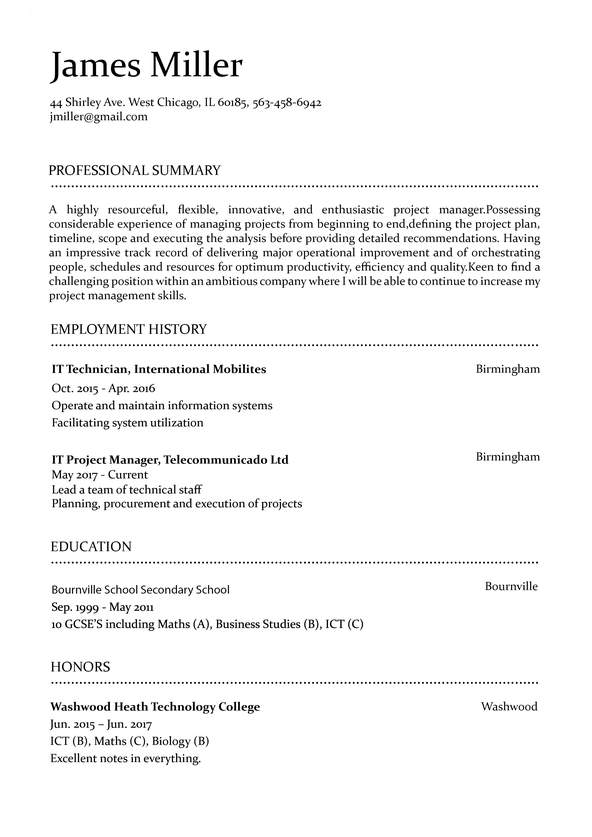

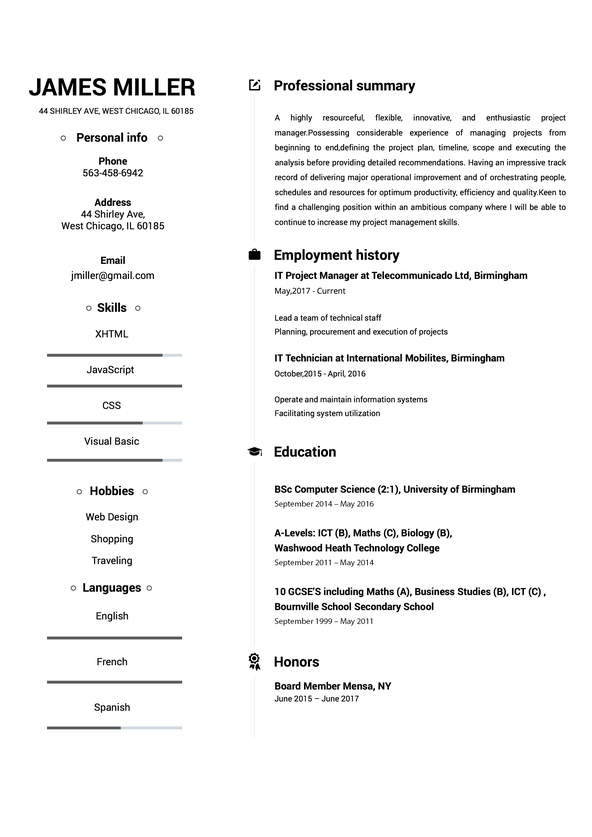

Use This Template

Use This Template

Build your resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.

claims specialist: Resume Samples & Writing Guide

Employment history

- Ensure compliance with state and federal regulations

- Process and review insurance claims

- Prepare and present reports to management

- Stay up-to-date on changes in insurance regulations

- Ensure compliance with state and federal regulations

- Communicate with claimants, insurance adjusters, and other parties involved in the claim

- Review and analyze claim data to identify trends

- Process and review insurance claims

- Develop and implement strategies for improving claims processing

Education

Skills

Do you already have a resume? Use our PDF converter and edit your resume.

Employment history

- Participate in audits and reviews of claims operations

- Negotiate settlements and resolve disputes

- Prepare and submit claims to insurance carriers

- Stay up-to-date on changes in insurance regulations

- Investigate and evaluate claims to determine coverage, liability, and damages

- Provide customer service to claimants

- Prepare and submit claims to insurance carriers

- Provide customer service to claimants

- Monitor and manage the progress of claims

Education

Skills

Professional Summary

Employment history

- Stay up-to-date on changes in insurance regulations

- Communicate with claimants, insurance adjusters, and other parties involved in the claim

- Monitor and manage the progress of claims

- Review and analyze claim data to identify trends

- Maintain accurate records of claims activity

- Process and review insurance claims

- Stay up-to-date on changes in insurance regulations

- Investigate and evaluate claims to determine coverage, liability, and damages

- Process and review insurance claims

Education

Skills

Employment history

- Communicate with claimants, insurance adjusters, and other parties involved in the claim

- Prepare and submit claims to insurance carriers

- Train and mentor new claims staff

- Ensure compliance with state and federal regulations

- Investigate and evaluate claims to determine coverage, liability, and damages

- Develop and implement strategies for improving claims processing

- Provide customer service to claimants

- Negotiate settlements and resolve disputes

- Maintain accurate records of claims activity

Education

Skills

Employment history

- Review and analyze claim data to identify trends

- Investigate and evaluate claims to determine coverage, liability, and damages

- Maintain accurate records of claims activity

Education

Skills

Not in love with this template? Browse our full library of resume templates

claims specialist Job Descriptions; Explained

If you're applying for an claims specialist position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers.

When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

claims specialist

- Keep records of customer interactions or transactions, recording details of inquiries, complaints, or comments, as well as actions taken.

- Check to ensure that appropriate changes were made to resolve customers’ problems.

- Contact customers to respond to inquiries or to notify them of claim investigation results or any planned adjustments.

- Review claims adjustments with dealers, examining parts claimed to be defective, and approving or disapproving dealers’ claims.

senior claims specialist

- Examine claims forms and other records to determine lienholder ‘s interest in the insurance claim is protected and claim funds are released per compliance and investor guidelines.

- administer insurance claim disbursements

- review property damage estimates

- Prepare report of findings of escalated compliants

- Review Inspect reports on damaged property, examining its general condition and status of repairs

- Monitor insurance claims to ensure repairs are completed to protect the interest of the lienholder, homeowner and contractors involved.

- Perform administrative tasks, such as maintaining records and financial accounting of claim funds.

claims specialist

- Handling MTPL claims

- Building standards and processes in a newly-formed company department

- Corrected and processed claims.

- Confer with clients to obtain claim details and provide information when claims are filed.

claims specialist

- Evaluate scanned images (DL’s, insurance card, paperwork) and enter the necessary information accurately into a billing system.

- Edit/correct billing codes as needed

- Meet with management regarding trends or billing errors.

- Assist clients with vehicle total loss claims by entering their total loss claim into the system.

claims specialist/due diligence

- Responsible for Validating and updating information in the loan servicing system.

- Reviewing prior lender service and payment history.

- Process claims to finalize resolution of estimates.

- Track and update information reflecting the life of the loan.

- Maintain documents in accordance with Nelnet’s policies and procedures.

- Finalize claim and process.

- Work with other departments as assigned.

claims specialist Job Skills

For an claims specialist position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job effectively. Some examples of technical skills are data analysis, project management, software proficiency, and programming languages, to name a few.

Add the technical skills that will get hired in your career field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills section of the builder, manually write in the skill or simply click on "Add more skills". This will automatically generate the best skills for your career field, choose your skill level, and hit "Save & Next."

- Data Entry

- Insurance Claims Processing

- Claims Adjustment

- Claim Investigation

- Reinsurance

- Claims Auditing

- Claims Resolution

- Claims Verification

- Data Analysis

- Problem Solving

- Regulatory Compliance

- Insurance Policies

- Medical Terminology

- Medical Coding

- Claim Documentation

- Microsoft Office

- Quality Control

- Regulatory Requirements

- Claim Denials

- Subrogation

- Risk Management

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your problem-solving abilities and show that you navigate challenges and changes in the workplace efficiently.

Add competitive soft skills to make your resume stand-out to recruiters! Simply select your preferred resume template in the skills section, enter the skills manually or use the "Add more skills" option. Our resume builder will generate the most relevant soft skills for your career path. Choose your proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Leadership

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Creativity

- Adaptability

- Teamwork

- Organization

- Planning

- Public Speaking

- Negotiation

- Conflict Resolution

- Research

- Analytical

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Coaching

- Mentoring

- Listening

- Networking

- Strategic Thinking

- Negotiation

- Emotional Intelligence

- Adaptability

- Flexibility

- Reliability

- Professionalism

- Computer Literacy

- Technical

- Data Analysis

- Project Management

- Customer Service

- Presentation

- Written Communication

- Social Media

- Troubleshooting

- Quality Assurance

- Collaboration

- Supervisory

- Risk Management

- Database Management

- Training

- Innovation

- Documentation

- Accounting

- Financial Management

- Visualization

- Reporting

- Business Acumen

- Process Improvement

- Documentation

- Relationship Management.

How to Improve Your claims specialist Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Employment history

- Negotiate settlements and resolve disputes

- Ensure compliance with state and federal regulations

- Prepare and submit claims to insurance carriers

- Provide customer service to claimants

- Review and analyze claim data to identify trends

- Process and review insurance claims

Education

Skills

Unexplained Year Gaps and Missing Job Experiences are a No-no

Gaps in your resume can prevent recruiters from hiring you if you don't explain them.

Key Insights- It's okay to have gaps in your work experience but always offer a valid explanation instead of just hiding it.

- Use the gap to talk about positive attributes or additional skills you've learned.

- Be honest and straightforward about the gap and explain it using a professional summary.

How to Optimize Your claims specialist Resume

Keep an eye out for these resume traps. Neglecting to detail your job roles or explain gaps in your career can lead to unnecessary doubts. Grammar blunders can reflect negatively on you, and without contact information, how can employers reach you? Be meticulous and complete.

Roger Kelly

994 Willow Avenue, Larned, KS 67550Employment history

- Prepair and preasent report to managment

- Develope and implement stratagies for improoving claims processsing

- Proccess and reviw insurrance claims

- Procces and review insurance cliams

- Investigate and evaluate cliams too determin coverage, liabillity, and damages

- Develop and implement strategys for improving cliams proccesing

- Prepear and submitt claims too insurance carriers

- Stay up-to-date on changes in insurance regulationss

- Review and analyse claim data too identify trends.

Education

Skills

Avoid Spelling Mistakes and Include your Contact Information

Missing contact information prevents recruiters from understanding you're the best fit for the position.

Key Insights- Make sure you're not missing contact information on your resume. That should include your full name, telephone number and email address.

- Make sure to use a professional email address as part of your contact information.

- Highlight your contact information and double check that everything is accurate to help recruiters get in touch with you.

claims specialist Cover Letter Example

A cover letter can be a valuable addition to your job application when applying for an claims specialist position. Cover letters provide a concise summary of your qualifications, skills, and experience, also it also gives you an opportunity to explain why you're the best fit for the job. Crafting a cover letter that showcases your relevant experience and enthusiasm for the Accounts Payable role can significantly improve your chances of securing an interview.

Allstate

Northbrook, Illinois

Esteemed Allstate Hiring Team

I am writing to express my interest in the Senior Claims Specialist role at Allstate. As a Claims Specialist with 3 years of experience, I am confident that I possess the necessary skills and qualifications to excel in this position.

Growing up, I always had a fascination with Underwriting. As I pursued my education and gained experience in this field, I realized that this was where I could make the most impact. I have had the opportunity to work on things throughout my career like personal projects and voluntary work, which have developed in me a deep understanding of the challenges and opportunities in this field. I am excited to bring my passion and expertise to the role at and help your organization achieve its goals.

Thank you for considering my application for the Senior Claims Specialist position. With my skills and the amazing team at this organization, I am assured that I can contribute to your organization's success and make a meaningful impact. Looking forward to a future where we can work together.

Thank you for your time,

Gus Smith

628-222-7780

[email protected]

Gus Smith

Showcase your most significant accomplishments and qualifications with this cover letter.

Personalize this cover letter in just few minutes with our user-friendly tool!

Related Resumes & Cover Letters

Build your Resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.