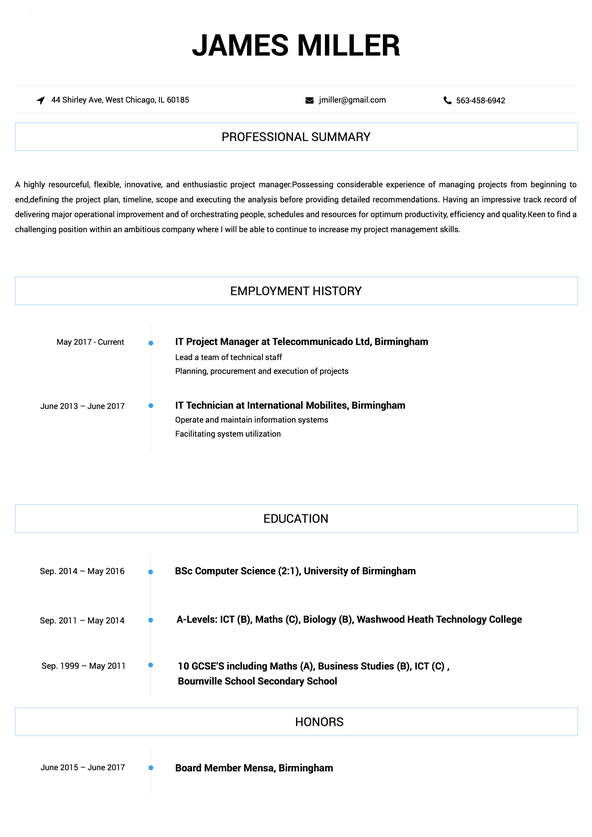

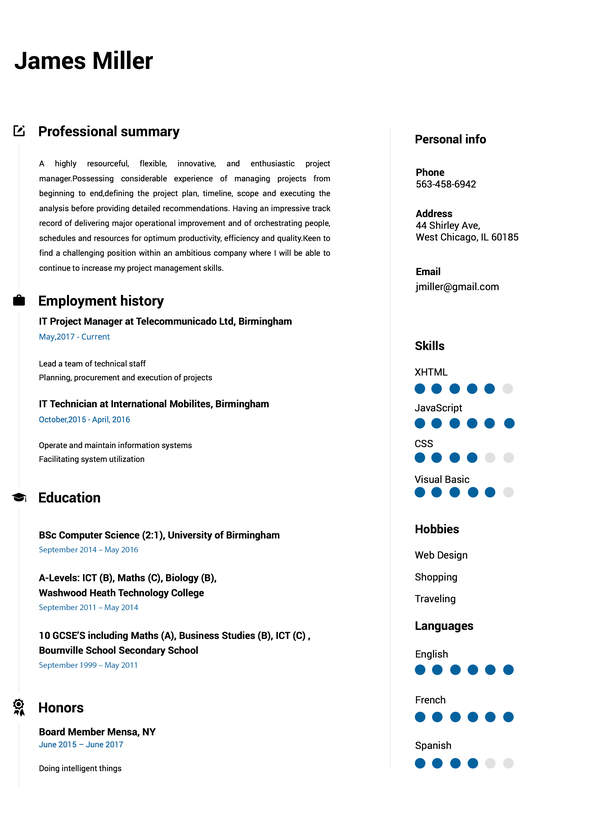

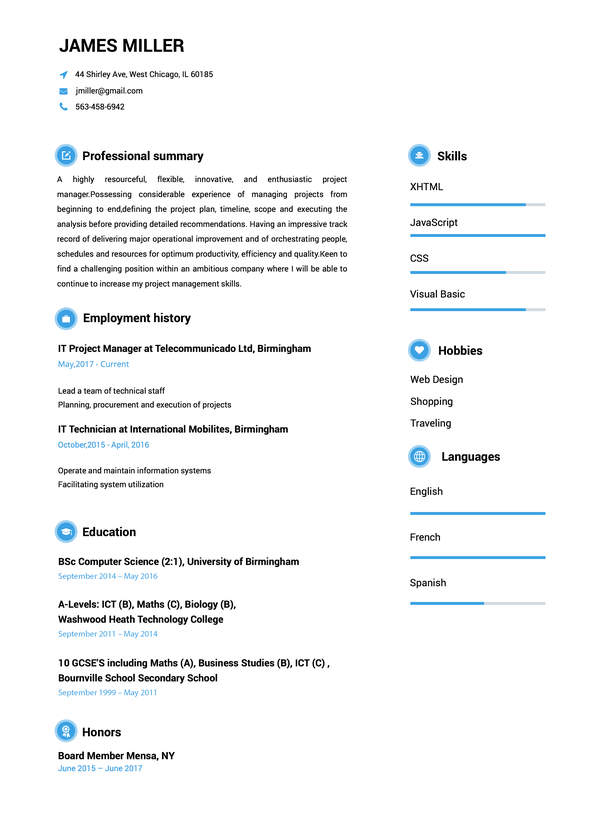

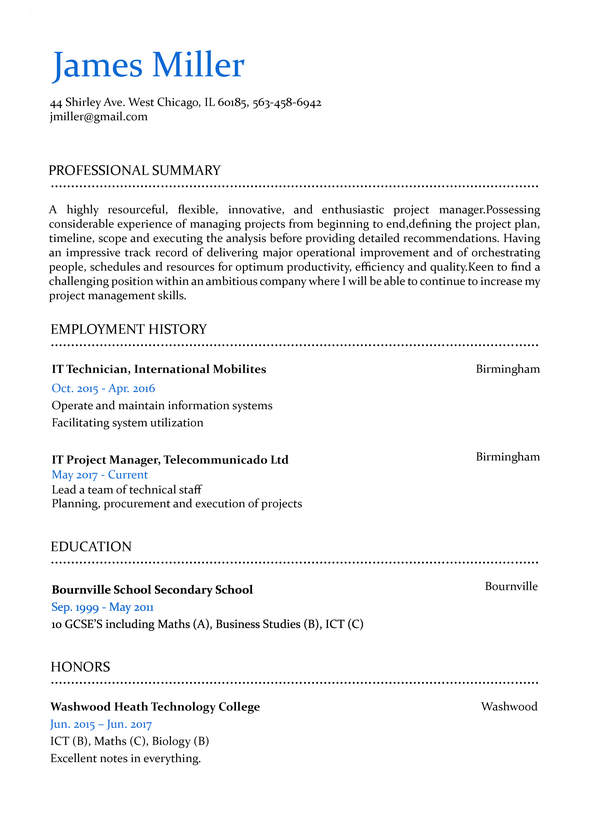

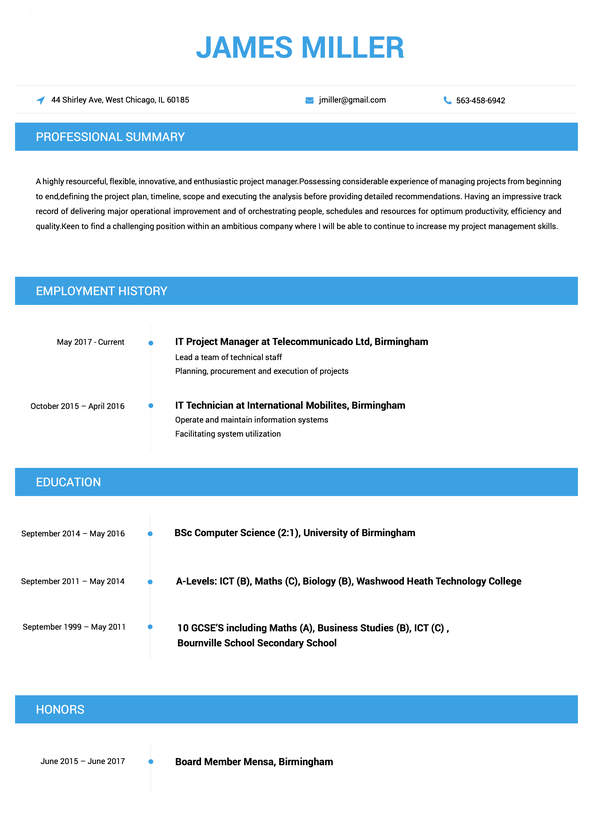

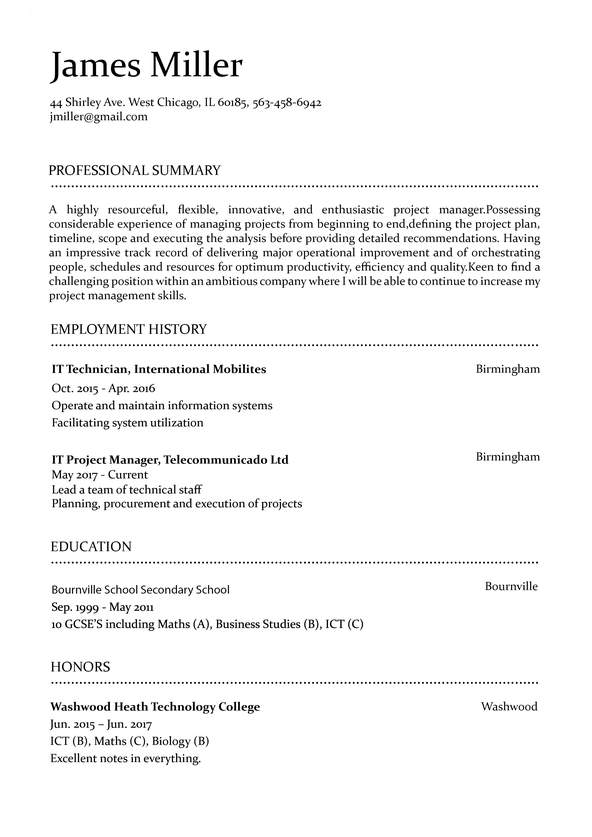

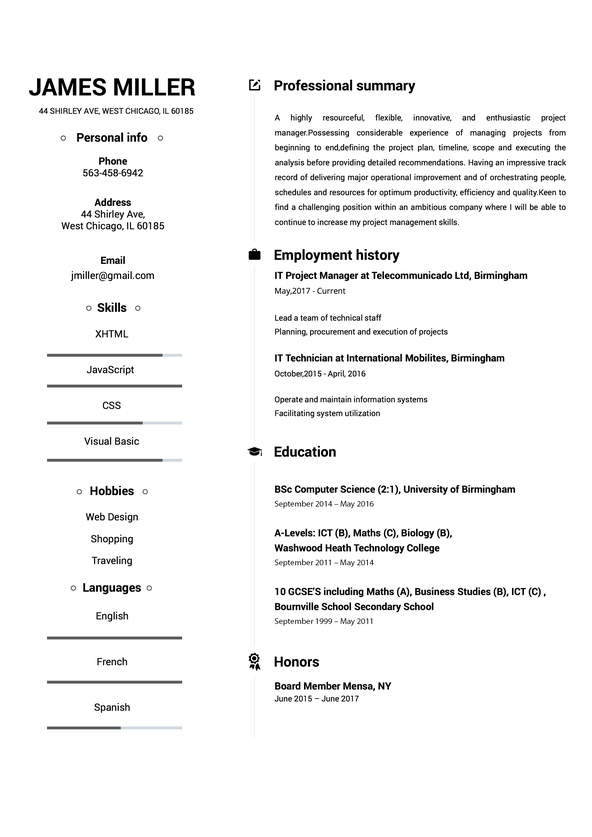

Use This Template

Use This Template

Build your resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.

claims analyst: Resume Samples & Writing Guide

Professional Summary

Employment history

- Participate in audits and provide reports as needed

- Respond to customer inquiries and provide customer service

- Investigate and analyze complex claims and determine coverage and liability

- Review and interpret policy language to determine coverage and liability

- Manage and monitor the progress of claims through resolution

- Develop and implement procedures to ensure compliance with applicable laws and regulations

- Maintain up-to-date knowledge of claims-related laws and regulations

- Participate in audits and provide reports as needed

- Manage and monitor the progress of claims through resolution

Education

Skills

Do you already have a resume? Use our PDF converter and edit your resume.

Employment history

- Manage and monitor the progress of claims through resolution

- Prepare and maintain detailed claim files and records

- Establish and maintain relationships with customers, agents, and other business partners

Education

Skills

Professional Summary

Employment history

- Investigate and analyze complex claims and determine coverage and liability

- Manage and monitor the progress of claims through resolution

- Review and interpret policy language to determine coverage and liability

- Manage and monitor the progress of claims through resolution

- Monitor and analyze claim trends and make recommendations for improvement

- Prepare and maintain detailed claim files and records

- Establish and maintain relationships with customers, agents, and other business partners

- Prepare and present reports on claims activity and trends

- Analyze and process claim payments in accordance with policy guidelines

Education

Skills

Professional Summary

Employment history

- Maintain up-to-date knowledge of claims-related laws and regulations

- Manage and monitor the progress of claims through resolution

- Investigate and analyze complex claims and determine coverage and liability

- Analyze and process claim payments in accordance with policy guidelines

- Prepare and maintain detailed claim files and records

- Establish and maintain relationships with customers, agents, and other business partners

- Manage and monitor the progress of claims through resolution

- Review and interpret policy language to determine coverage and liability

- Participate in audits and provide reports as needed

Education

Skills

Employment history

- Prepare and maintain detailed claim files and records

- Utilize knowledge of medical terminology, legal terminology, and insurance coverage to evaluate claims

- Monitor and analyze claim trends and make recommendations for improvement

- Prepare and maintain detailed claim files and records

- Analyze and process claim payments in accordance with policy guidelines

- Maintain up-to-date knowledge of claims-related laws and regulations

- Manage and monitor the progress of claims through resolution

- Negotiate settlements of claims with customers and other parties

- Analyze and process claim payments in accordance with policy guidelines

Education

Skills

Not in love with this template? Browse our full library of resume templates

claims analyst Job Descriptions; Explained

If you're applying for an claims analyst position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers.

When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

claims analyst

- Handle auto claims involving damage to vehicle, or liability claims involving third party vehicle or third party bodily injury from liability situations, such as motor vehicle accidents.

- Policy interpretation, investigate a loss, deciding the policy covers the loss.

- Examine claim and provide decisions accurately.

- Inspect vehicle damage to determine degree of damages.

- Examine photographs and statements.

- Consult with car manufacture, police, and field surveyor for expert evaluation.

- Verify overall coverage during the point of accident.

claims analyst

- Analysis of Claim data to find reason behind deviation from expected result of different claim parameters.

- Coordinating with fraud and actuary team and creating Fraud Risk Model for claim department.

- Making Board meeting ppt for National Manager based on data analysis.

- Finding Magma Ranking within 30 days settlement quarterly based on NL-24 and 25 data uploaded by companies on IRDAI website.

- Coordinating with IT department to resolve system issues.

claims analyst

- Ensures accurate review of claims document like LOA, hospital bills/SOA concurrent review form, physicians report, original OR for use in processing claims.

- Reviews and match the endorsed document againts the actual encoded data in the system.

- Evaluates claims and adjudicates claims to ensure claims are according to benefits plan, coverage and policies and standards.

- Accurately evaluates and process Out-patient and In-patient claim reimbursement and non-reimbursement, received from various providers and meet the required quota.

claims analyst

- Acting liason for General Motors customers and suppliers in investigating and claim that may result in asset loss

- Oversaw return and exchange processes from customer to supplier

- Took corrective action in the case of accidents and delays to minimize extra expenses

- Gathered, logged and monitored all shipping data

- Analyzed and reviewed claims for accuracy, completeness, eligibility and detailed research in verifying claims

- Monitored claims from start to finish making decision to determine reimbursement in a timely manner

claims analyst

- Process and adjust claims.

- Transfer to correct department when necessary.

- Knowledge of ICD-10 codes.

- Daily use of 10-Key.

- Knowledge of Dual monitors.

- Proficient in hotkeys.

claims analyst Job Skills

For an claims analyst position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job effectively. Some examples of technical skills are data analysis, project management, software proficiency, and programming languages, to name a few.

Add the technical skills that will get hired in your career field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills section of the builder, manually write in the skill or simply click on "Add more skills". This will automatically generate the best skills for your career field, choose your skill level, and hit "Save & Next."

- Data Entry

- Insurance Claims Processing

- Insurance Claims Adjustment

- Claim Investigations

- Claims Resolution

- Claims Auditing

- Claims Negotiation

- Claims Documentation

- Claims System Maintenance

- Claims System Troubleshooting

- Claims Analysis

- Claim Verification

- Medical Coding

- Medical Terminology

- HIPAA Compliance

- Regulatory Compliance

- Policy Knowledge

- Technical Writing

- Data Analysis

- Data Mining

- Microsoft Office

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your problem-solving abilities and show that you navigate challenges and changes in the workplace efficiently.

Add competitive soft skills to make your resume stand-out to recruiters! Simply select your preferred resume template in the skills section, enter the skills manually or use the "Add more skills" option. Our resume builder will generate the most relevant soft skills for your career path. Choose your proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Leadership

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Creativity

- Adaptability

- Teamwork

- Organization

- Planning

- Public Speaking

- Negotiation

- Conflict Resolution

- Research

- Analytical

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Coaching

- Mentoring

- Listening

- Networking

- Strategic Thinking

- Negotiation

- Emotional Intelligence

- Adaptability

- Flexibility

- Reliability

- Professionalism

- Computer Literacy

- Technical

- Data Analysis

- Project Management

- Customer Service

- Presentation

- Written Communication

- Social Media

- Troubleshooting

- Quality Assurance

- Collaboration

- Supervisory

- Risk Management

- Database Management

- Training

- Innovation

- Documentation

- Accounting

- Financial Management

- Visualization

- Reporting

- Business Acumen

- Process Improvement

- Documentation

- Relationship Management.

How to Improve Your claims analyst Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Cecil Ingram

64 Applewood Drive, Cassel, CA 96016Employment history

- Develop and implement procedures to ensure compliance with applicable laws and regulations

- Establish and maintain relationships with customers, agents, and other business partners

- Manage and monitor the progress of claims through resolution

- Negotiate settlements of claims with customers and other parties

- Analyze and process claim payments in accordance with policy guidelines

- Establish and maintain relationships with customers, agents, and other business partners

- Investigate and analyze complex claims and determine coverage and liability

- Analyze and process claim payments in accordance with policy guidelines

- Respond to customer inquiries and provide customer service

Education

Skills

Provide your Contact Information and Address Year Gaps

Always explain any gaps in your work history to your advantage.

Key Insights- Employers want to know what you've accomplished, so make sure to explain any gaps using a professional summary.

- Adding extra details and context to explain why you have a gap in your work history shows employers you are a good fit for the position.

How to Optimize Your claims analyst Resume

Keep an eye out for these resume traps. Neglecting to detail your job roles or explain gaps in your career can lead to unnecessary doubts. Grammar blunders can reflect negatively on you, and without contact information, how can employers reach you? Be meticulous and complete.

Professional Summary

Employment history

- Participate in audits, and provide report's as needed.

- Analyze, and process claim payment's in accordance with policy guideline's.

- Manage, and monitor the progress of claim's through resolution.

- Maintian up-to-date knowledge of claims-related laws and regulations

- Negotiate settlements of claims with customers and other partys

- Developed and implement procedures to ensure compliance with applicable laws and regulatiosn

- "I went to the store and bought some apples"

- I went too the store, an bought some apples.

Education

Skills

Include Job Descriptions and Avoid Bad Grammar

Avoid sending a wrong first impression by proofreading your resume.

Key Insights- Spelling and typos are the most common mistakes recruiters see in resumes and by simply avoiding them you can move ahead on the hiring process.

- Before submitting your resume, double check to avoid typos.

claims analyst Cover Letter Example

A cover letter can be a valuable addition to your job application when applying for an claims analyst position. Cover letters provide a concise summary of your qualifications, skills, and experience, also it also gives you an opportunity to explain why you're the best fit for the job. Crafting a cover letter that showcases your relevant experience and enthusiasm for the Accounts Payable role can significantly improve your chances of securing an interview.

Allstate

Northbrook, Illinois

To the Recruitment Team at Allstate

As a Claims Analyst with a proven track record of success in Insurance, I am excited to apply for the Senior Claims Analyst position at Allstate. I believe that my skills and expertise would make a valuable contribution to your team.

Growing up, I always had a fascination with Actuarial Science. As I pursued my education and gained experience in this field, I realized that this was where I could make the most impact. I have had the opportunity to work on things throughout my career like personal projects and voluntary work, which have developed in me a deep understanding of the challenges and opportunities in this field. I am excited to bring my passion and expertise to the role at and help your organization achieve its goals.

I am elated about the opportunity to join a team that shares my passion for this field, and values collaboration and innovation. I am confident that together we can overcome whatever tests and challenges are put on our way.

Kind regards,

Stanley Fox

787-805-0758

[email protected]

Stanley Fox

Showcase your most significant accomplishments and qualifications with this cover letter.

Personalize this cover letter in just few minutes with our user-friendly tool!

Related Resumes & Cover Letters

Build your Resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.