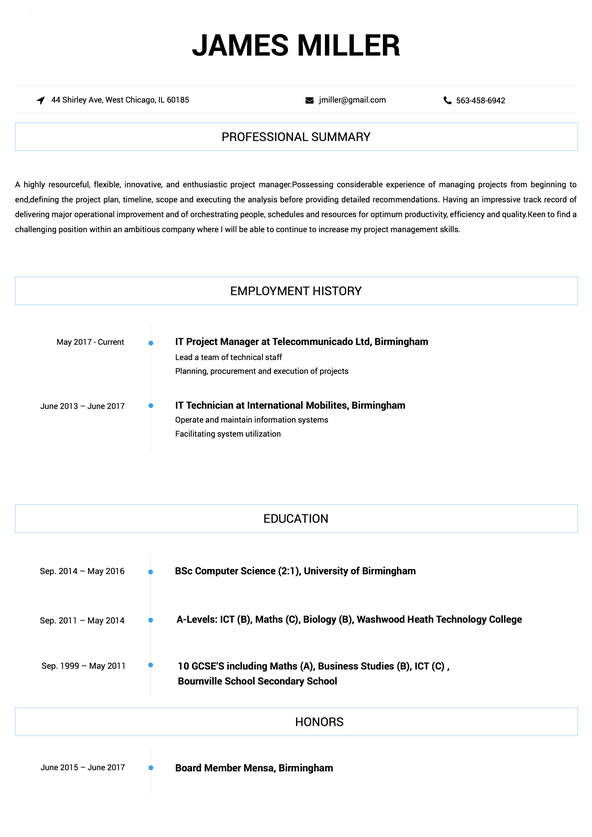

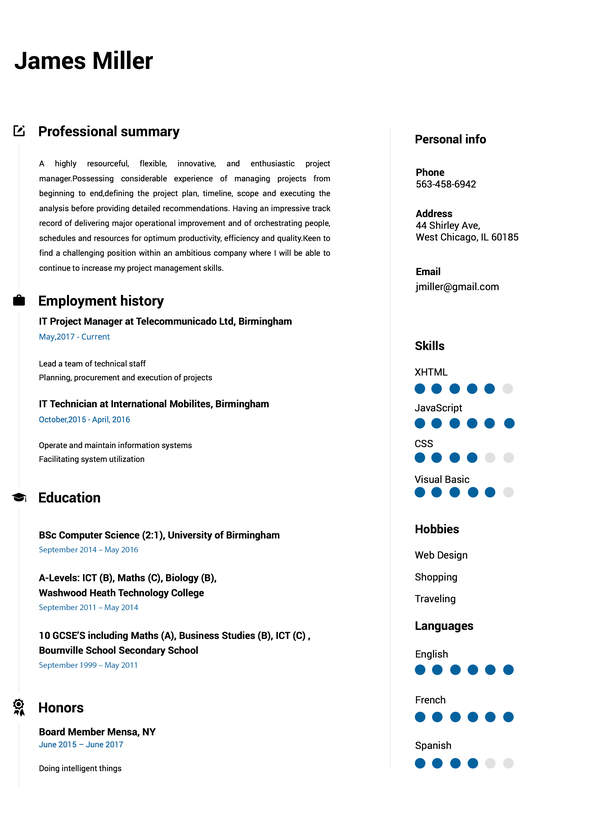

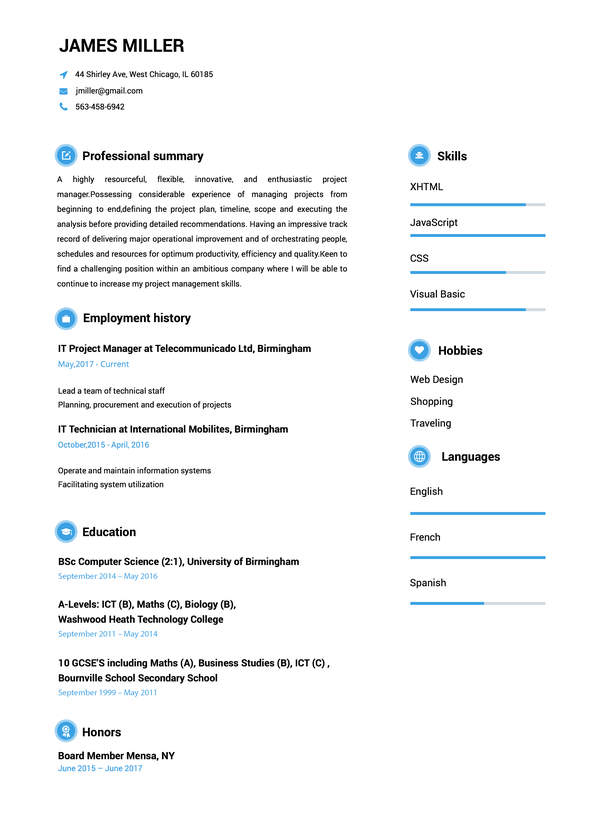

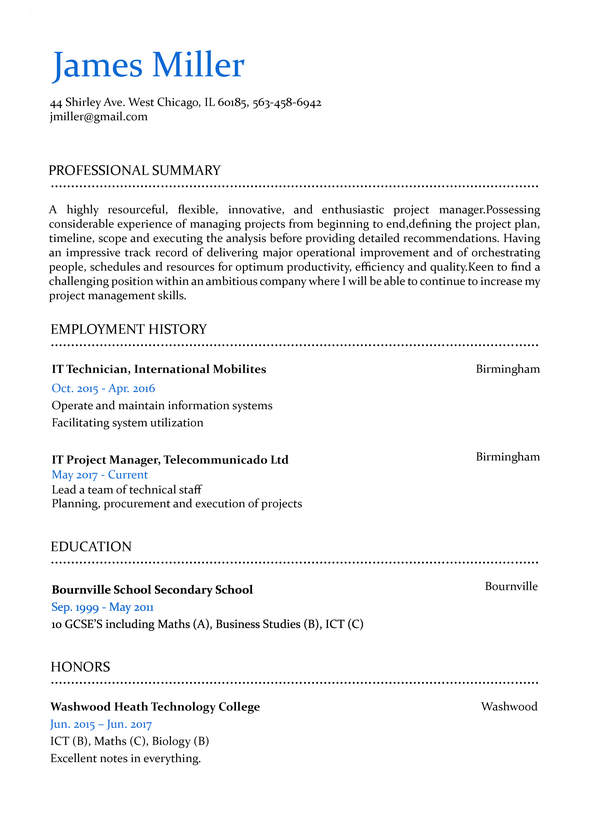

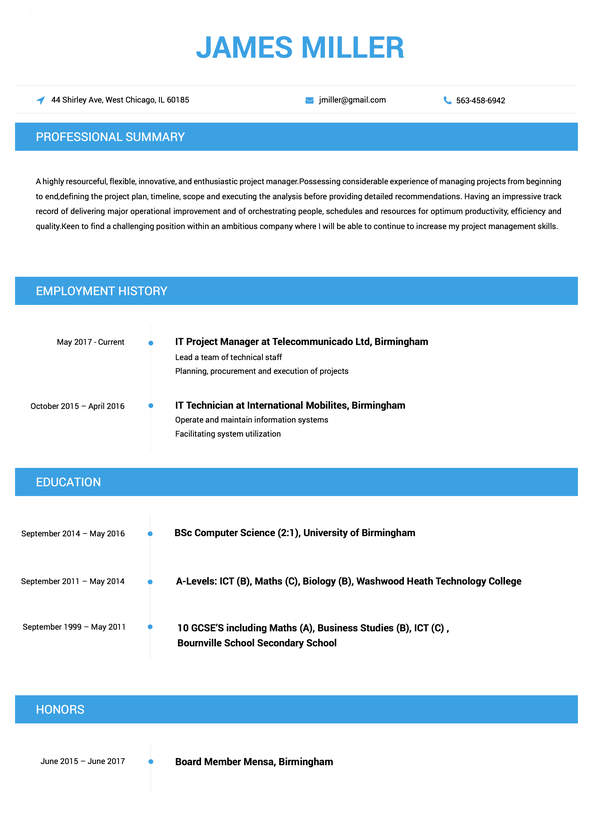

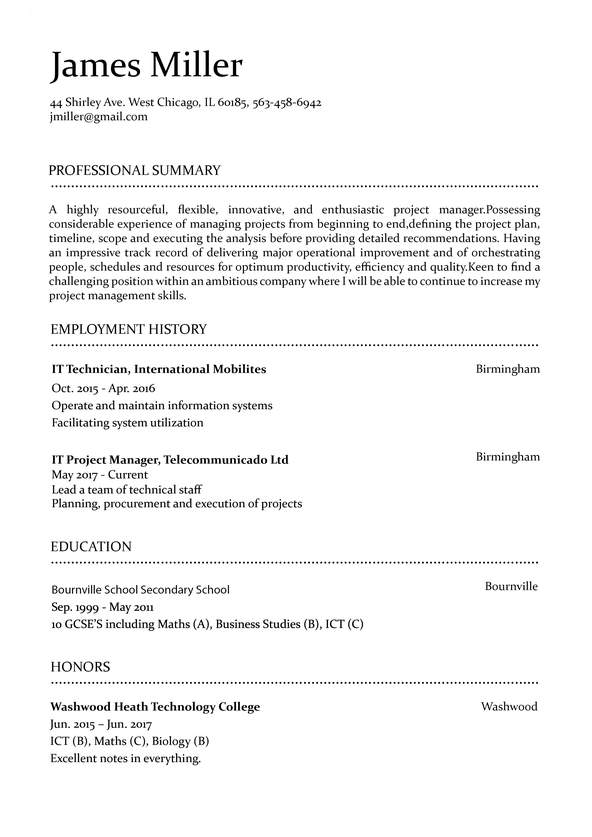

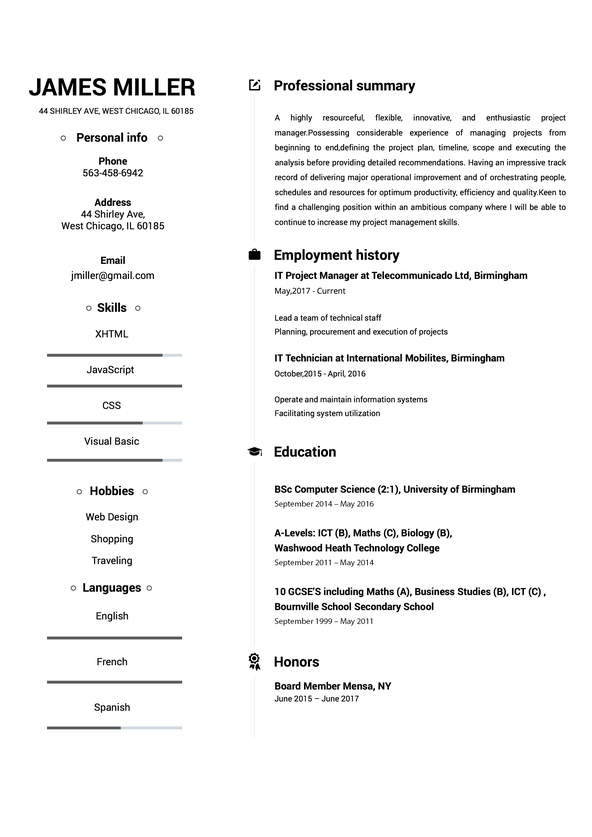

Use This Template

Use This Template

Build your resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.

actuary: Resume Samples & Writing Guide

Professional Summary

Employment history

- Develop and maintain actuarial models

- Participate in industry and professional organizations

- Conduct research and analysis to assess financial and operational impacts

- Monitor and analyze changes in laws and regulations

- Review and evaluate reinsurance contracts

- Develop pricing models and financial projections

- Develop pricing models and financial projections

- Analyze data to identify trends and assess risks

- Conduct research and analysis to assess financial and operational impacts

Education

Skills

Do you already have a resume? Use our PDF converter and edit your resume.

Professional Summary

Employment history

- Prepare reports and presentations to communicate results

- Analyze data to identify trends and assess risks

- Train and mentor junior actuarial staff

- Analyze data to identify trends and assess risks

- Participate in industry and professional organizations

- Review and evaluate reinsurance contracts

- Develop and maintain actuarial databases

- Monitor and analyze changes in laws and regulations

- Evaluate and recommend changes to company policies and procedures

Education

Skills

Professional Summary

Employment history

- Prepare financial statements and reports

- Monitor and analyze changes in laws and regulations

- Analyze data to identify trends and assess risks

- Develop pricing models and financial projections

- Prepare financial statements and reports

- Review and evaluate reinsurance contracts

- Evaluate and recommend changes to company policies and procedures

- Monitor and analyze changes in laws and regulations

- Prepare reports and presentations to communicate results

Education

Skills

Employment history

- Monitor and analyze changes in laws and regulations

- Evaluate and recommend changes to company policies and procedures

- Develop and implement strategies to manage risk

- Develop and maintain actuarial databases

- Evaluate and recommend changes to company policies and procedures

- Train and mentor junior actuarial staff

- Prepare financial statements and reports

- Analyze data to identify trends and assess risks

- Prepare reports and presentations to communicate results

Education

Skills

Professional Summary

Employment history

- Participate in the development of new products

- Participate in industry and professional organizations

- Develop and implement strategies to manage risk

- Develop pricing models and financial projections

- Prepare financial statements and reports

- Develop and maintain actuarial models

- Participate in industry and professional organizations

- Train and mentor junior actuarial staff

- Monitor and analyze changes in laws and regulations

Education

Skills

Not in love with this template? Browse our full library of resume templates

actuary Job Skills

For an actuary position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job effectively. Some examples of technical skills are data analysis, project management, software proficiency, and programming languages, to name a few.

Add the technical skills that will get hired in your career field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills section of the builder, manually write in the skill or simply click on "Add more skills". This will automatically generate the best skills for your career field, choose your skill level, and hit "Save & Next."

- Data Modeling

- Actuarial Modeling

- Insurance Underwriting

- Financial Analysis

- Statistical Analysis

- Predictive Modeling

- SAS Programming

- Excel Modeling

- Mathematical Modeling

- Coding

- R Programming

- Actuarial Science

- Data Analysis

- Risk Management

- Financial Reporting

- Actuarial Valuation

- Insurance Products

- Insurance Regulations

- Reinsurance

- Insurance Pricing

- Actuarial Analysis

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your problem-solving abilities and show that you navigate challenges and changes in the workplace efficiently.

Add competitive soft skills to make your resume stand-out to recruiters! Simply select your preferred resume template in the skills section, enter the skills manually or use the "Add more skills" option. Our resume builder will generate the most relevant soft skills for your career path. Choose your proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Leadership

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Creativity

- Adaptability

- Teamwork

- Organization

- Planning

- Public Speaking

- Negotiation

- Conflict Resolution

- Research

- Analytical

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Coaching

- Mentoring

- Listening

- Networking

- Strategic Thinking

- Negotiation

- Emotional Intelligence

- Adaptability

- Flexibility

- Reliability

- Professionalism

- Computer Literacy

- Technical

- Data Analysis

- Project Management

- Customer Service

- Presentation

- Written Communication

- Social Media

- Troubleshooting

- Quality Assurance

- Collaboration

- Supervisory

- Risk Management

- Database Management

- Training

- Innovation

- Documentation

- Accounting

- Financial Management

- Visualization

- Reporting

- Business Acumen

- Process Improvement

- Documentation

- Relationship Management.

How to Improve Your actuary Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Victor Davis

137 Applewood Drive, Polk, OH 44866Employment history

- Develop and maintain actuarial models

- Participate in the development of new products

- Evaluate and recommend changes to company policies and procedures

- Participate in industry and professional organizations

- Analyze data to identify trends and assess risks

- Train and mentor junior actuarial staff

Education

Skills

Include your Contact Information and Job Descriptions

Missing job descriptions lessens your chances of getting hired.

Key Insights- Employers want to know what you've accomplished, so make sure to include descriptions for all of your previous jobs.

- Keep job descriptions short but don't just list your jobs.

- Never copy-paste a job description to post on your resume. Get inspired and use tools to help you write customized descriptions.

How to Optimize Your actuary Resume

Keep an eye out for these resume traps. Neglecting to detail your job roles or explain gaps in your career can lead to unnecessary doubts. Grammar blunders can reflect negatively on you, and without contact information, how can employers reach you? Be meticulous and complete.

Employment history

- Develp and maintian actuarail modles.

- Deveop and implemnet strageties too manage risk.

- Conducts researches and analyses to asses financials and operational impacts.

- Mointor and analize changs in lawes and regulatins.

- Develp n' maintain actuaril models.

- Conduct researchs and analysises to asses financials and operational impacts.

- Moniter and analyse changes in law's and regulations.

- Deveop and maintian actuarail databses.

- Manege project's an' coordinate activities wit' other departmens.

Education

Skills

Correct Grammar and Address Gap Years in Your Resume

Don't leave unexplained gaps in your work history.

Key Insights- When explaining gaps in your employment section, start by being honest.

- Elaborate on the gap and show that you never stopped learning.

- Explain and elaborate any gap in your work history by highlighting new skills.

actuary Cover Letter Example

A cover letter can be a valuable addition to your job application when applying for an actuary position. Cover letters provide a concise summary of your qualifications, skills, and experience, also it also gives you an opportunity to explain why you're the best fit for the job. Crafting a cover letter that showcases your relevant experience and enthusiasm for the Accounts Payable role can significantly improve your chances of securing an interview.

USAA

San Antonio, Texas

USAA Recruitment Team

I am a passionate Actuary with 13 years of experience in Insurance. I am excited to submit my application for the Chief Actuary position at USAA, where I believe my skills and expertise would be a great asset to your team.

As someone who has always been committed to making a positive impact on the world, I have pursued opportunities to contribute to my community through my work wherever I may be. My experience in this field has equipped me with the skills and knowledge necessary to succeed throughout my life and I am confident that they will help me to bring my passion and expertise to your organization and help drive your success.

I appreciate the opportunity to apply for the Chief Actuary position. I am confident that I can make a valuable contribution to your organization and that together there is no challenge that we cannot overcome. I will be waiting, hopeful for what the future will bring.

Your time is appreciated,

Ben Nelson

974-444-3227

[email protected]

Ben Nelson

Showcase your most significant accomplishments and qualifications with this cover letter.

Personalize this cover letter in just few minutes with our user-friendly tool!

Related Resumes & Cover Letters

Build your Resume in 15 minutes

Create an awesome resume that meets the expectations of potential employers with our selection of professional, field-tested resume templates.